Table of Contents

Imagine waking up to find that hundreds of dollars in revenue have disappeared due to WooCommerce chargeback overnight. It all started with what seemed like a regular order; products shipped and the customer paid. But weeks later, you get hit with a chargeback, and the payment is reversed. Suddenly, that order isn’t so routine anymore.

According to the Chargeback trends and outlook 2023 report, global chargeback transaction volumes are expected to surge by 42%, reaching a staggering 337 million by 2026. That’s why taking proactive steps to prevent chargebacks is so important.

WooCommmerce store owners should prioritize prevention over simply reacting to disputes. Automated tools like risk scoring and order screening are essential in protecting your business from the three most common sources of chargebacks: fraudulent transactions, unauthorized card use, and friendly fraud.

Fraudulent transactions are a primary driver of chargebacks, making their prevention a key strategy. Thankfully, tools like Dotstore’s Fraud Prevention plugin can help you tackle this challenge head-on. In this guide, we’ll walk you through actionable strategies to reduce chargebacks, protect your revenue, and maintain customer trust. Let’s dive in!

Understanding the true cost of WooCommerce chargebacks to your store

Chargebacks happen when a customer disputes a charge, leading the payment processor to reverse the transaction. These are forced refunds initiated through the customer’s card issuer/bank rather than directly with the merchant. Some chargebacks are legitimate, like issues with undelivered products or billing mistakes. However, many are the result of fraudulent claims or “friendly fraud” when customers misuse the chargeback system after receiving goods or services.

For store owners, the financial implications of WooCommerce chargebacks are significant. In 2021, the average value of a chargeback increased by 21% to $293.04. And that’s just the tip of the iceberg.

Here’s how chargebacks can impact your business:

- Impact on overall operational costs: Chargebacks don’t just mean refunded payments. They include additional fees, lost goods, shipping, and even marketing expenses. Plus, the time spent resolving disputes adds up.

- Payment processor relationship impact: If your chargeback ratio goes too high (Visa’s threshold is 0.9%, Mastercard’s is 1.5%), you could face penalties, extra monitoring, or even risk losing your payment processor account.

- Impact on WooCommerce store processing options: A high chargeback rate can limit your payment gateway options, forcing you into higher deposits or worse terms.

- Merchant category implications: Consistent chargebacks could reclassify your store as high-risk, which means higher fees and fewer growth opportunities.

“Chargebacks aren’t just a cost of doing business – they threaten your sustainability. Every chargeback affects not just your revenue but your relationship with payment processors and your ability to grow. That’s why automated prevention is crucial for modern eCommerce stores.”

Nimesh Patel, Product Growth Manager at Dotstore

With these risks in mind, it’s clear that automated WooCommerce chargeback prevention is essential for protecting your store’s bottom line and ensuring its long-term success.

WooCommerce Chargeback Prevention strategies

By combining smart security measures, you’ll shield your store from fraud and save yourself from the stress of WooCommerce Chargeback and managing disputes. Let’s explore some of the best prevention strategies for fraud orders.

1. Enable real-time transaction monitoring

Real-time monitoring systems act like digital detectives, scanning each transaction for red flags. They check things like IP addresses, email domains, locations, and payment methods to catch suspicious activity before it harms your store.

For example, if a customer’s IP address shows they’re in one country but their billing address is in another, real-time monitoring would flag that transaction and stop it in its tracks.

2. Set custom risk thresholds and scoring

Not all stores are alike, so why use a one-size-fits-all fraud detection method? Create custom fraud detection rules that match your unique needs. Each transaction gets a risk score based on factors like location, device, and purchase history. You can then decide what level of risk is acceptable and block anything that crosses that line.

Tip: Many fraud detection plugins let you fine-tune these rules to reduce false positives and keep your operations running smoothly.

3. Use automated blacklisting and blocking

If you’ve got repeat offenders, let automation take over. Blacklisting tools can block transactions based on specific criteria, like flagged IPs, email domains, or locations. You won’t have to waste time manually tracking risky behavior anymore.

4. Require multi-layered authentication

Sometimes, one layer of security just isn’t enough. Adding extra verification steps, like Address Verification System (AVS), 3D Secure, and CVV checks, ensures the buyer is really authorized to use the payment method. These layers provide peace of mind for you and your customers.

Fraudsters hate extra steps. Multi-layered authentication makes it harder for them to misuse stolen card details, lowering the chances of chargebacks.

5. Establish evidence collection practices

When disputes pop up, having solid evidence is key to winning the case. WooCommerce makes it easy to collect and store proof based on what you’re selling.

- For digital products: Keep proof of access, download records, IP logs, and device details.

- For physical products: Maintain delivery proof, tracking numbers, and signed receipts.

6. Collaborate with payment processors

Your payment gateway is more than just a tool. It is also a fraud-fighting partner. Platforms like Stripe, PayPal, and Authorize.net have built-in fraud detection features to flag risky transactions before they’re processed.

Bonus tip: Be aware of dispute fees. PayPal charges $20, while Square does not charge anything.

7. Keep policies clear and visible

Make sure your return, refund, and dispute policies are clear and easy to find. When customers know the rules from the start, you’ll face fewer misunderstandings and unnecessary disputes.

How automated fraud detection protects your revenue

Automated fraud detection acts as your WooCommerce store’s 24/7 security guard. It actively monitors every transaction to ensure it’s legitimate. By analyzing multiple data points like IP addresses, email domains, browser fingerprints, and location data, these systems detect and flag suspicious activity before it can lead to costly chargebacks.

When fraud is detected, automated systems take immediate action. Based on your configured thresholds, they can cancel fraudulent orders or hold fraud orders for review. This proactive approach prevents revenue loss from fraudulent transactions and saves you from chargeback fees, which can range from $15 to $50 per dispute.

For seamless fraud prevention, consider using Dotstore’s WooCommerce Fraud Prevention plugin. It is a great tool for automating fraud detection and blocking suspicious transactions, helping you secure your revenue and focus on growing your business.

WooCommerce Fraud Prevention

Equip your store with our feature-rich fraud prevention plugin to reduce risk and safeguard your profits.

14-day, no-questions-asked money-back guarantee.

WooCommerce Chargeback management with Fraud Prevention

The WooCommerce Fraud Prevention plugin by DotStore provides a robust and intuitive solution to help safeguard your store against chargebacks and fraudulent activities. Let’s explore how this plugin’s key features work to protect your revenue and streamline fraud management.

Real-time monitoring and automation

This plugin continuously monitors transactions for suspicious activity, offering more than just fraud detection. It also helps uncover valuable customer insights.

- Detect suspicious patterns instantly.

- Cancel or pause suspicious orders automatically based on pre-set rules.

- Learn from purchasing patterns to enhance your understanding of legitimate customer behavior.

- Flag suspicious activities like mismatched billing addresses or flagged email domains.

With these features, you can act immediately to mitigate potential threats while maintaining a frictionless shopping experience for legitimate customers.

Advanced user blocking

The plugin’s blocking features prevent fraudsters from re-entering your store using multiple entry points.

- Block users by IP address, browser fingerprint, email, domain, ZIP code, phone number, and more.

- Set blocks during registration and checkout for full-cycle protection.

- Use bulk uploads of blacklisted emails, states, and ZIP codes via Excel sheets to save time.

- Automatically prevent repeat offenders from exploiting your store.

These tools ensure comprehensive and efficient fraud management.

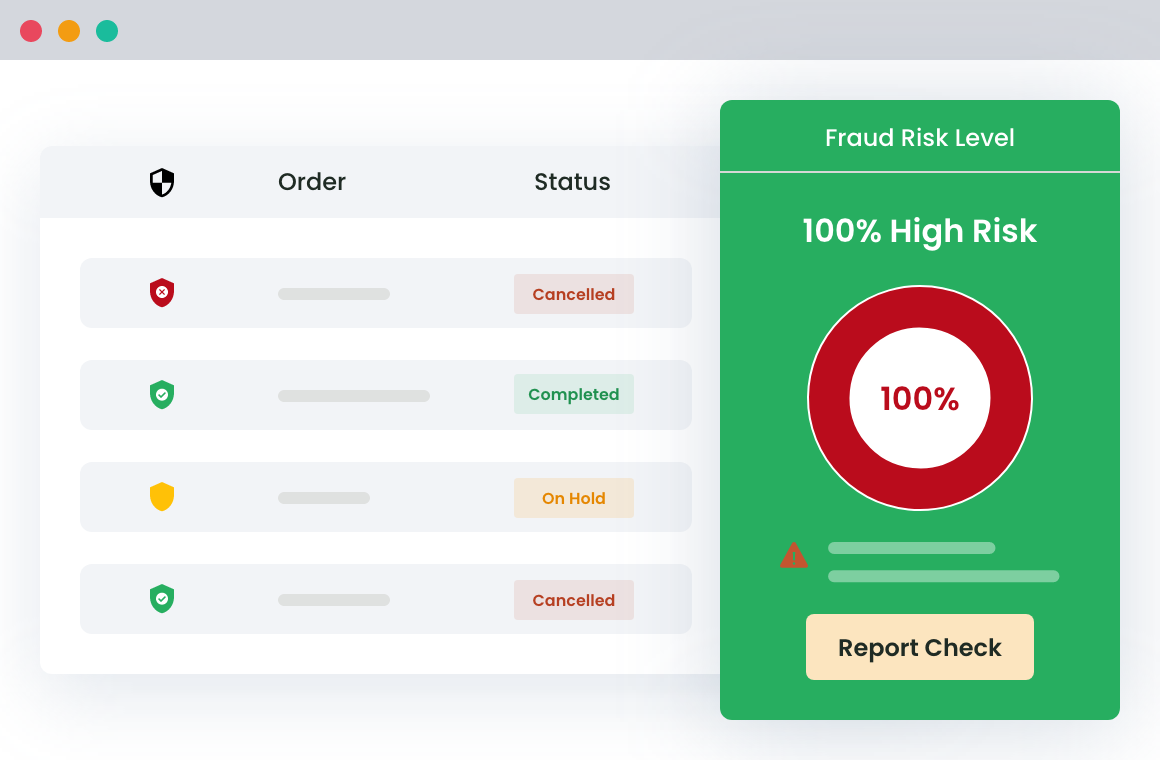

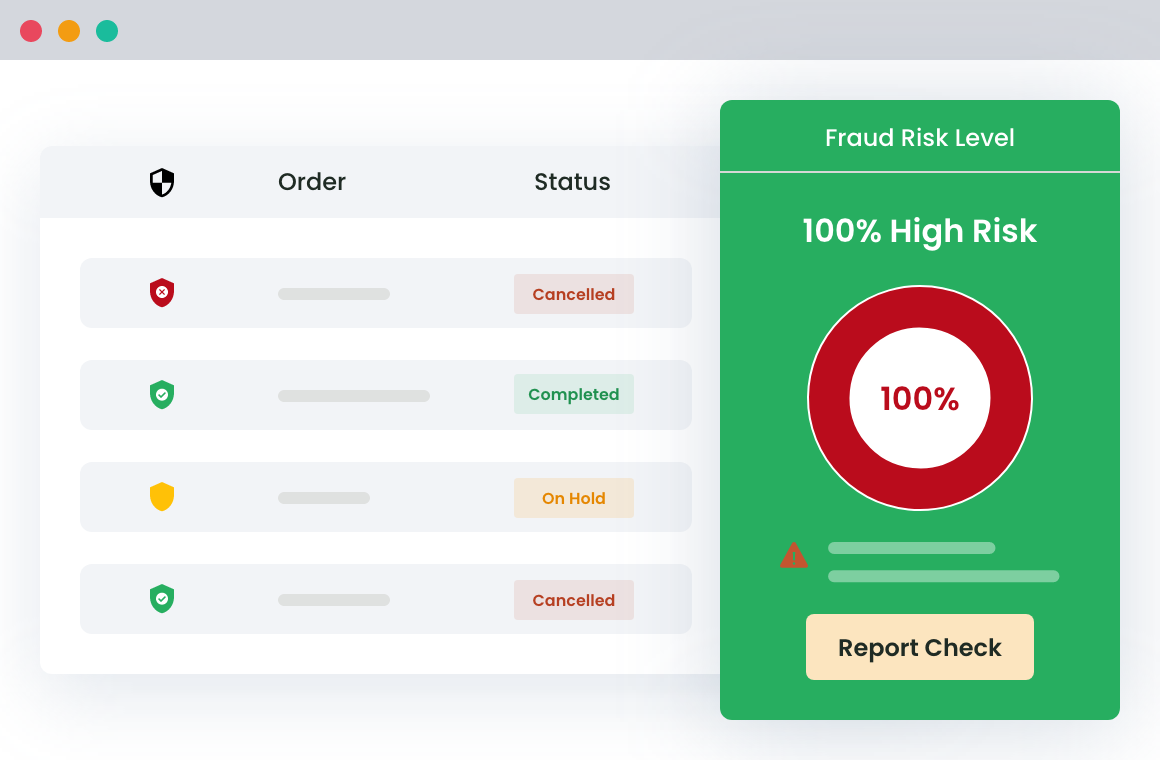

Smart risk scoring system

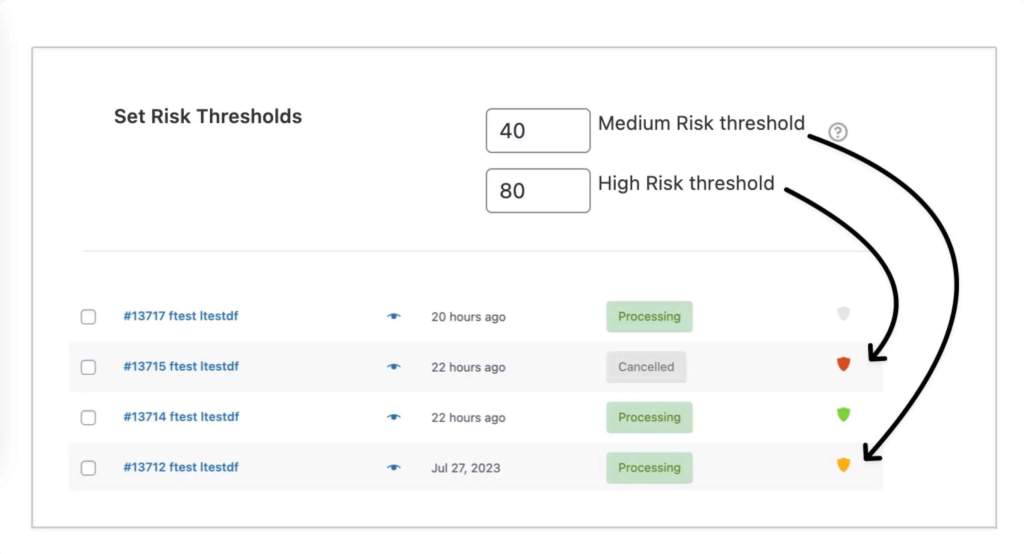

The risk scoring system enables dynamic fraud detection, allowing you to customize security levels for specific transactions:

- Assign risk scores using weighted factors like location and order history.

- Define custom fraud rules and thresholds for different products.

- Apply stricter scrutiny to high-value orders while using lenient settings for low-risk items.

- Blacklist users automatically when their score surpasses acceptable limits.

Easy management and monitoring

All security data is accessible directly in your WordPress Admin Dashboard.

- View blocked users, flagged transactions, and attempted fraud.

- Monitor the effectiveness of your fraud prevention settings.

- Fine-tune your thresholds based on results to reduce false positives and improve security accuracy.

How to respond to and win WooCommerce chargeback disputes

Dealing with chargebacks can be frustrating, but with the right approach, you can protect your revenue and resolve disputes effectively. Here’s how:

Understanding the chargeback dispute process

- Reviewing the chargeback notice: Read the chargeback notice carefully. Understand why the customer filed it.

- Timeline awareness: Most disputes need a response within 7–10 days. Don’t miss this window, as it could lead to an automatic loss.

- Gathering relevant information: Gather everything you need, like order details, payment records, and communication history with the customer.

Collecting strong evidence to support your case

- Transaction receipts: Submit detailed order confirmations and payment proof.

- Customer communication logs: Include emails, chats, or support tickets that show you tried to resolve the issue.

- Delivery proof: For physical goods, provide tracking numbers or signatures.

- Usage logs for digital products: Share logs showing downloads or usage by the customer.

Best practices for managing chargeback disputes amicably

- Initiating direct communication: Try resolving the issue directly. Many disputes can be cleared up with a quick conversation.

- Offering refunds or credits: For minor issues, offering a refund can save time and protect your reputation.

- Collaborating with payment processors: Payment providers may be able to provide guidance and support.

- Maintaining consistent policies: Clear return and refund policies reduce confusion and disputes.

Tracking and improving your dispute success rate

- Analyzing common chargeback reasons: Look for patterns in chargeback reasons. Fix recurring problems.

- Adjusting store policies: Refine product descriptions, terms, or customer service based on what you learn.

By responding quickly, staying organized, and learning from past disputes, you can reduce losses and protect your WooCommerce store.

Enable fraud prevention for your WooCommerce store today

Protecting your WooCommerce store from chargebacks and fraud doesn’t have to be overwhelming. With the right tools and strategies, you can secure your revenue and create a safer shopping experience for your customers.

Here’s how to get started:

- Assess your current chargeback rate and identify potential areas for improvement.

- Update your store policies to ensure they’re clear and customer-friendly.

- Implement basic fraud measures like Address Verification System (AVS) and CVV verification.

- Choose advanced tools that match your store’s needs for better fraud protection.

For complete peace of mind, Dotstore’s WooCommerce Fraud Prevention plugin provides powerful features like real-time monitoring, customizable risk scoring, and automated blocking. It’s a simple yet effective way to shield your store from fraud while saving time and resources.

Take control of your store’s security today. tart using WooCommerce Fraud Prevention and protect your hard-earned revenue.

WooCommerce Fraud Prevention

Equip your store with our feature-rich fraud prevention plugin to reduce risk and safeguard your profits.

14-day, no-questions-asked money-back guarantee.