Transform Checkout Experience with Dynamic Payment Methods

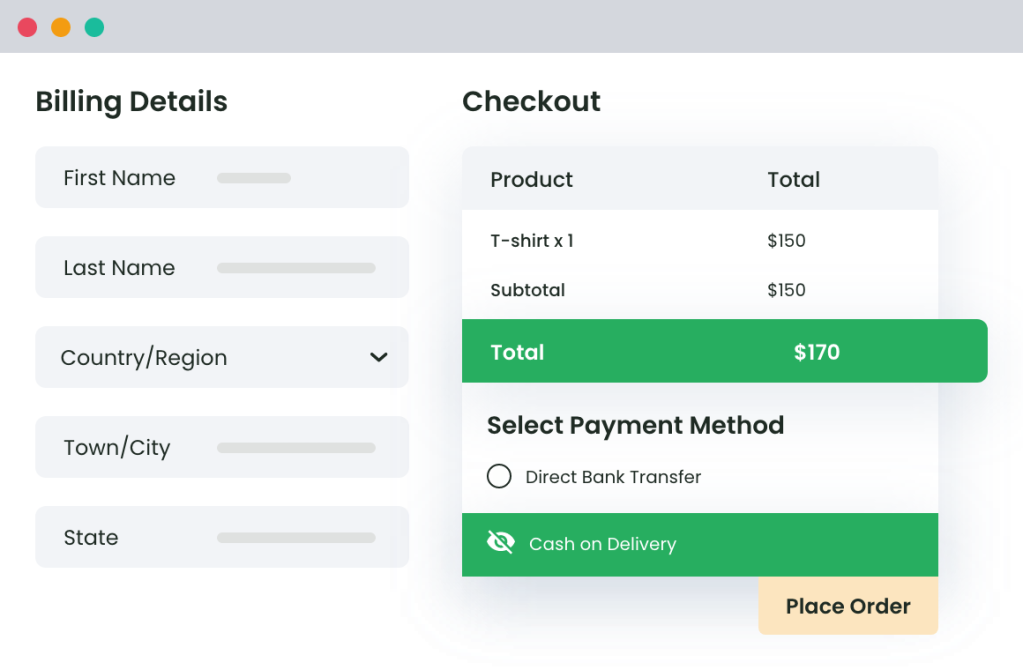

Our plugin intelligently showcases payment methods based on customer data to encourage checkout completion and reduce cart abandonment. Deliver a personalized shopping journey effortlessly.

300+

Happy Customers“Had this working within a half hour to charge a credit card processing fee.”

– Tonipogue4.8/5 Stars

Based on 40+ ReviewsImprove Customer Experience By Implementing

Relevant Payment Options.

Restrict Payment Methods for Specific Products

Easily limit payment options for particular products in the cart to refine the checkout process.

1. Customize payment options based on the products added to the cart.

2. Enhance control over payment methods for sensitive or high-value items.

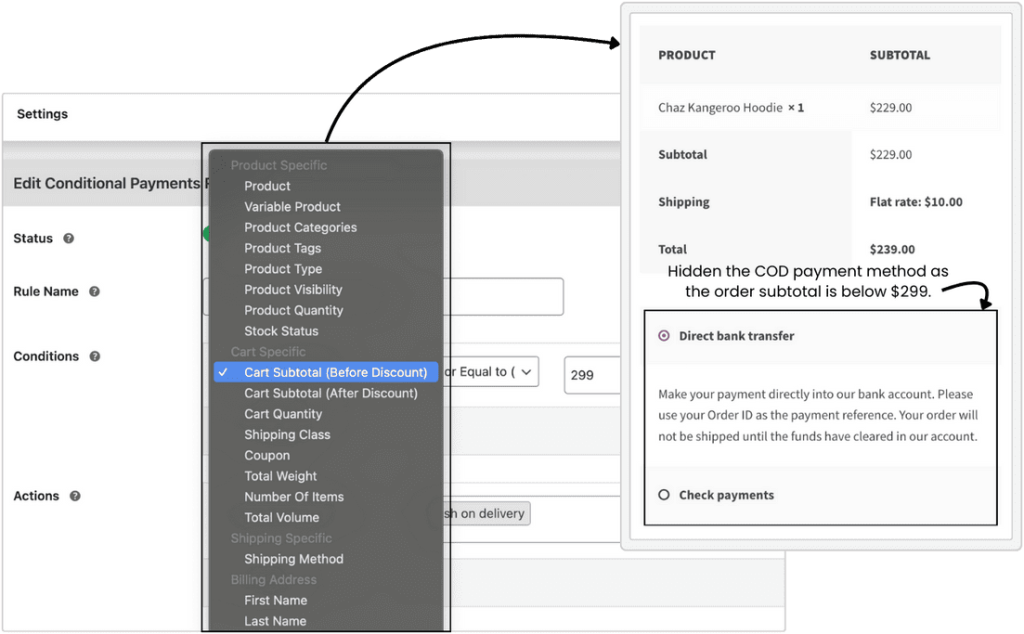

Restrict Payment Methods by Cart Total

Control payment methods based on cart subtotal, allowing for restrictions if the total is above or below a specified amount.

1. Prevent high-cost payment methods on small orders or low-cost methods on large ones.

2. Increase transaction flexibility with thresholds for specific payment methods.

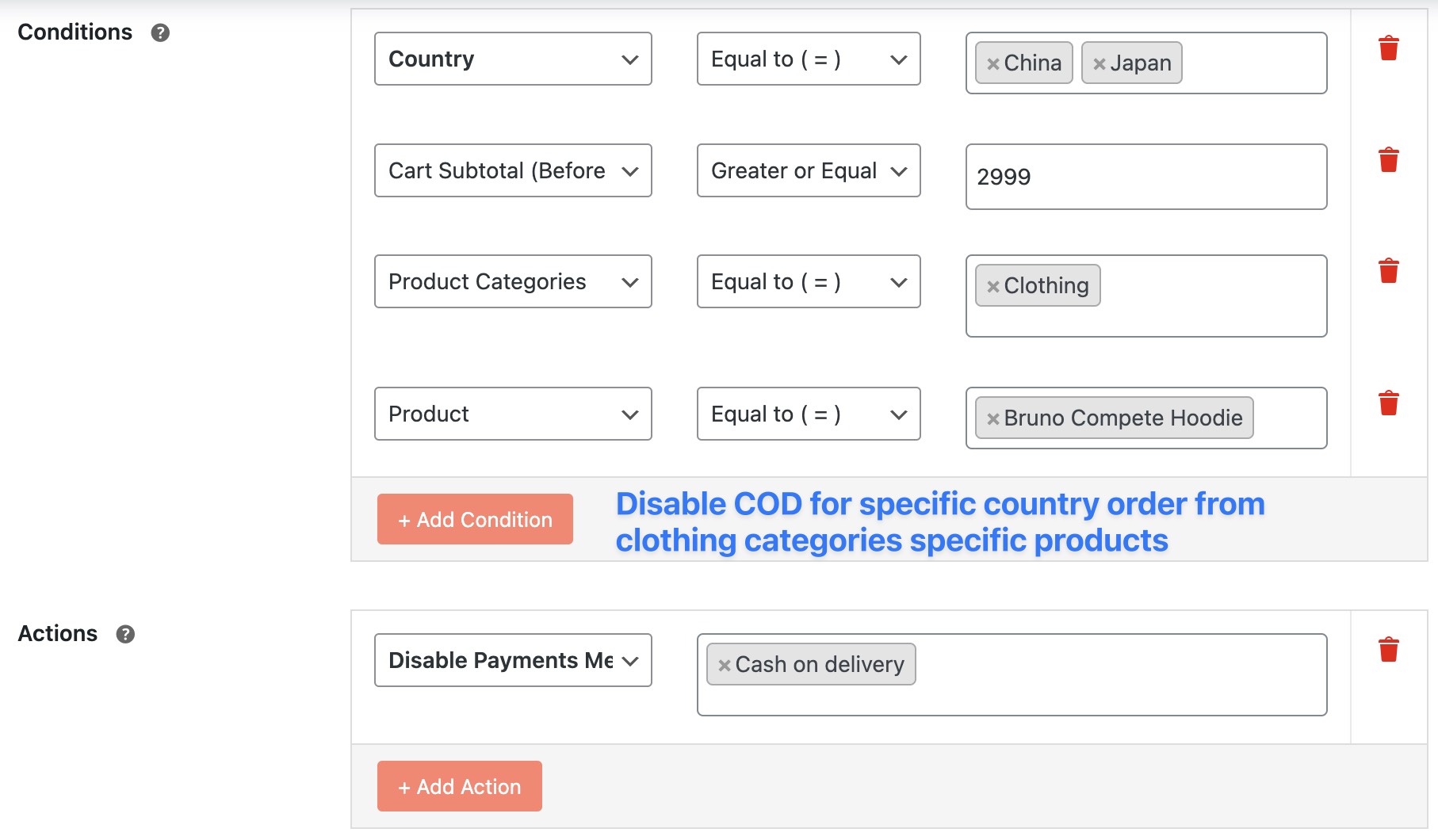

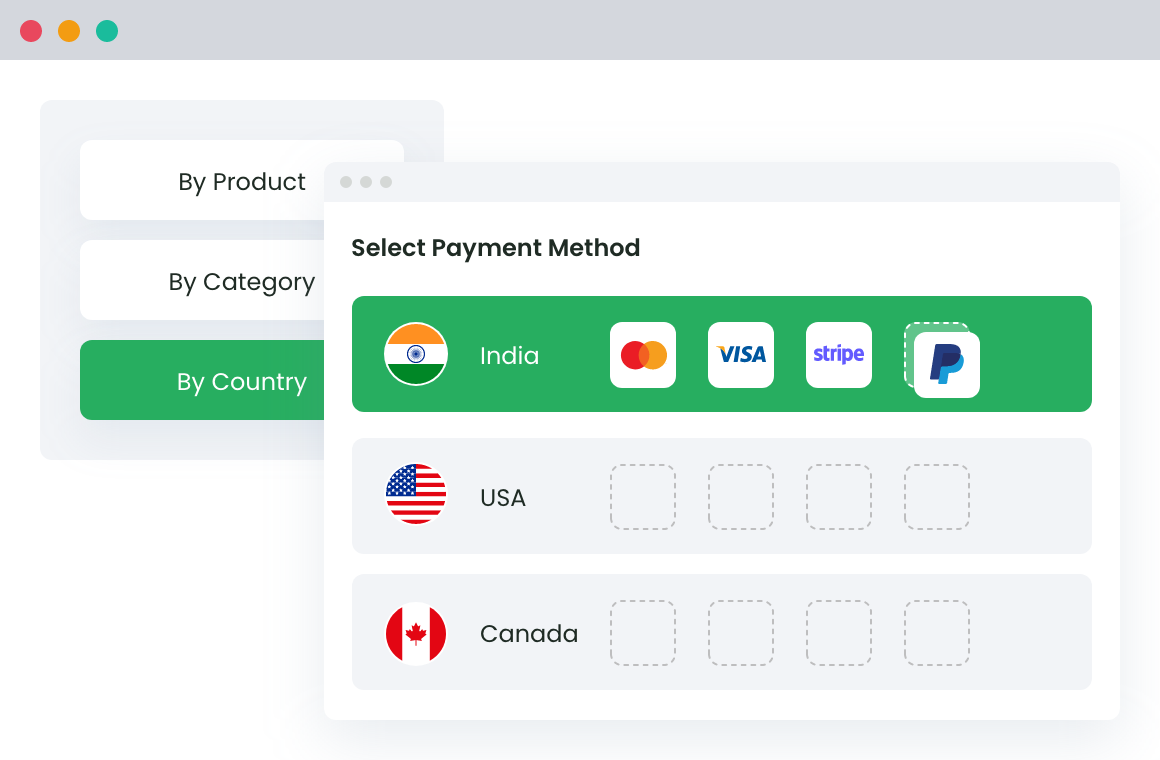

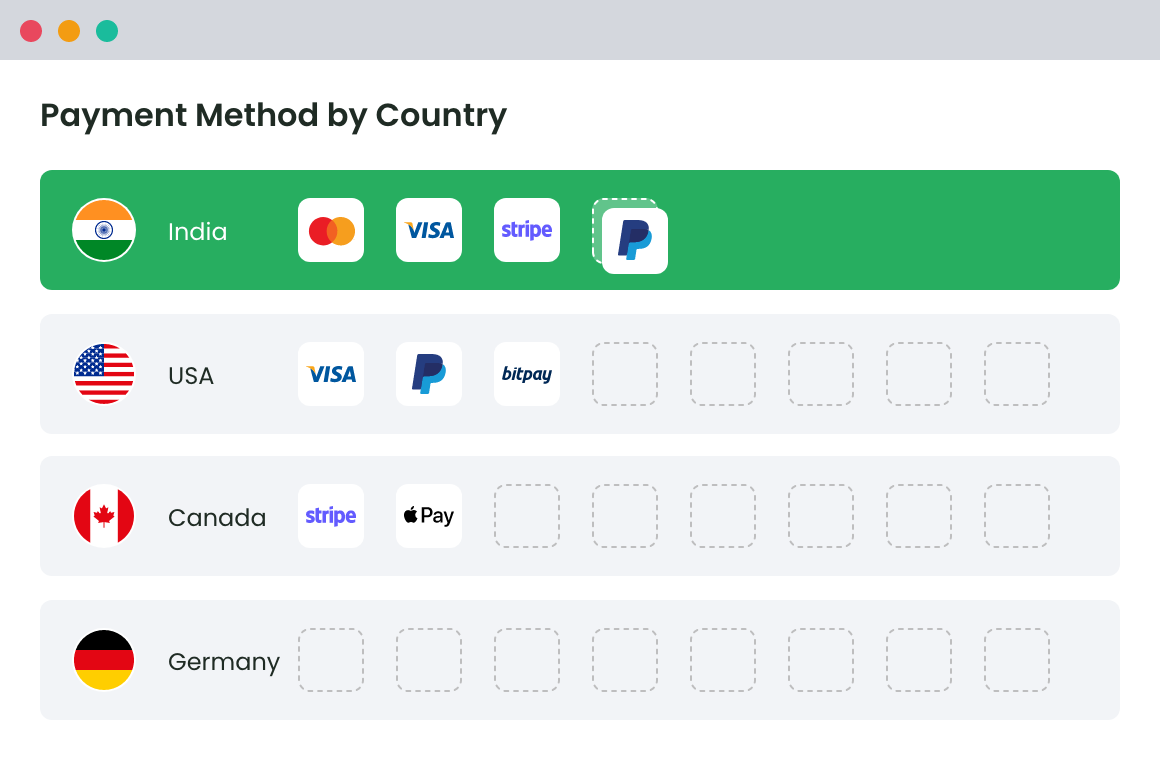

Restrict Payment Methods by Country

Customize available payment options based on the customer’s billing or shipping country to align with regional payment preferences or requirements.

1. Enhance payment security by restricting methods in high-risk regions.

2. Streamline international transactions by aligning payment options with location.

Customers love us 😍

An In-depth look at all our features

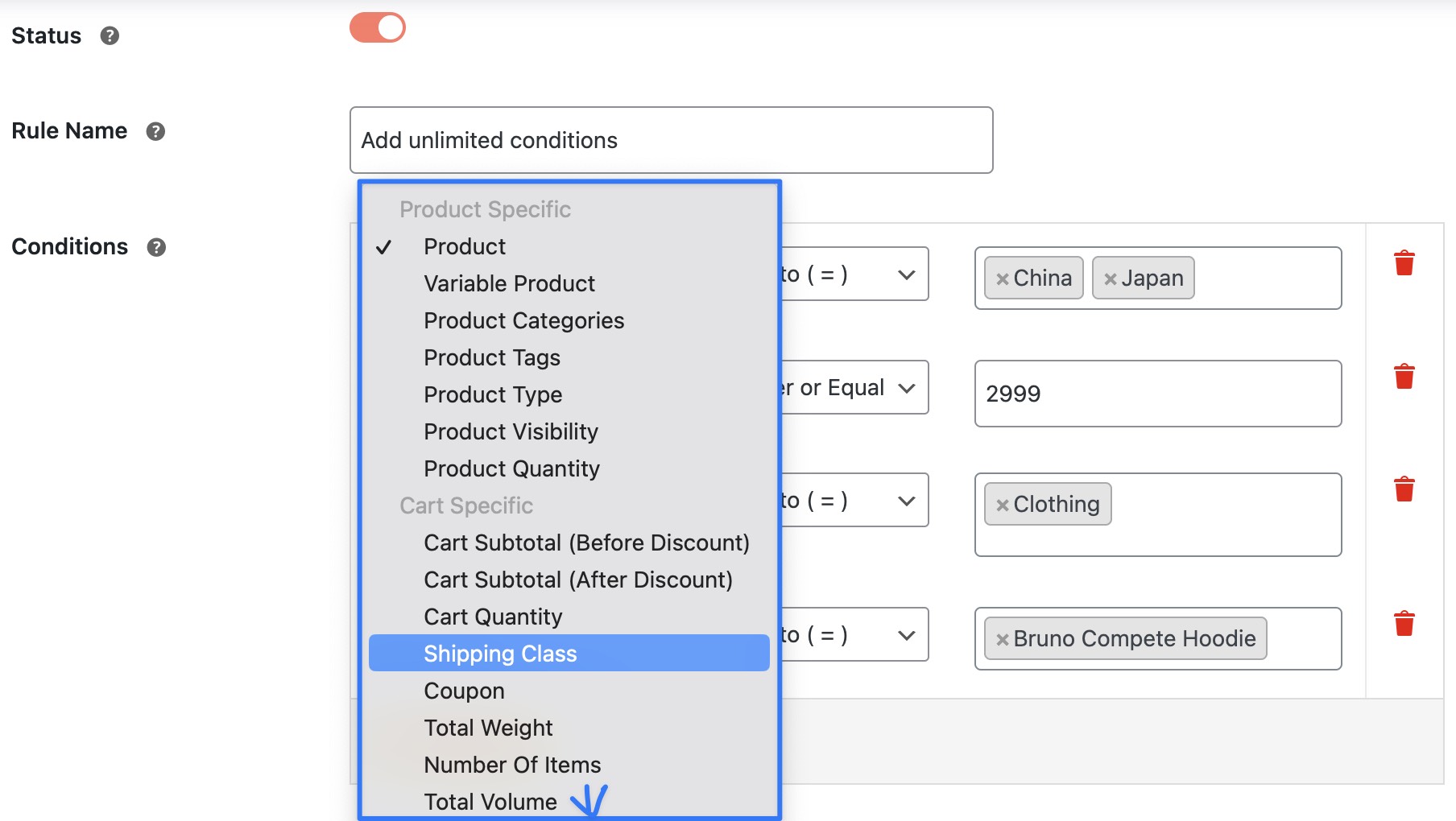

- Flexible Payment Method Restriction Rules

- Conditionally Enable Payments

- Conditionally Disable Payments

- Tailored Payment Gateway Fee

- Product-Specific Rules

- Cart-Specific Rules

- Shipping-Specific Rules

- Billing or Shipping Fields Related Rules

- Customer-Specific Rules

- Time-Specific Rules

- Debug Mode for Rules

- No Payment Custom Message

Enhance payment flexibility and control by setting specific restriction rules tailored to various shopping scenarios.

Effortlessly customize and restrict payment methods based on a wide range of advanced conditions, such as product-specific, location-specific, cart-specific, user-specific, and more.

This flexibility allows for precise rule configurations across various scenarios, whether restricting payment options for certain regions, product categories, based on the billing fields, or specific users.

- Restrict PayPal for customers with billing addresses outside your preferred regions.

- Limit Cash on Delivery to orders below a set subtotal to manage cash flow.

- Exclude certain gateways like Stripe for bulky orders by setting cart quantity-based restrictions.

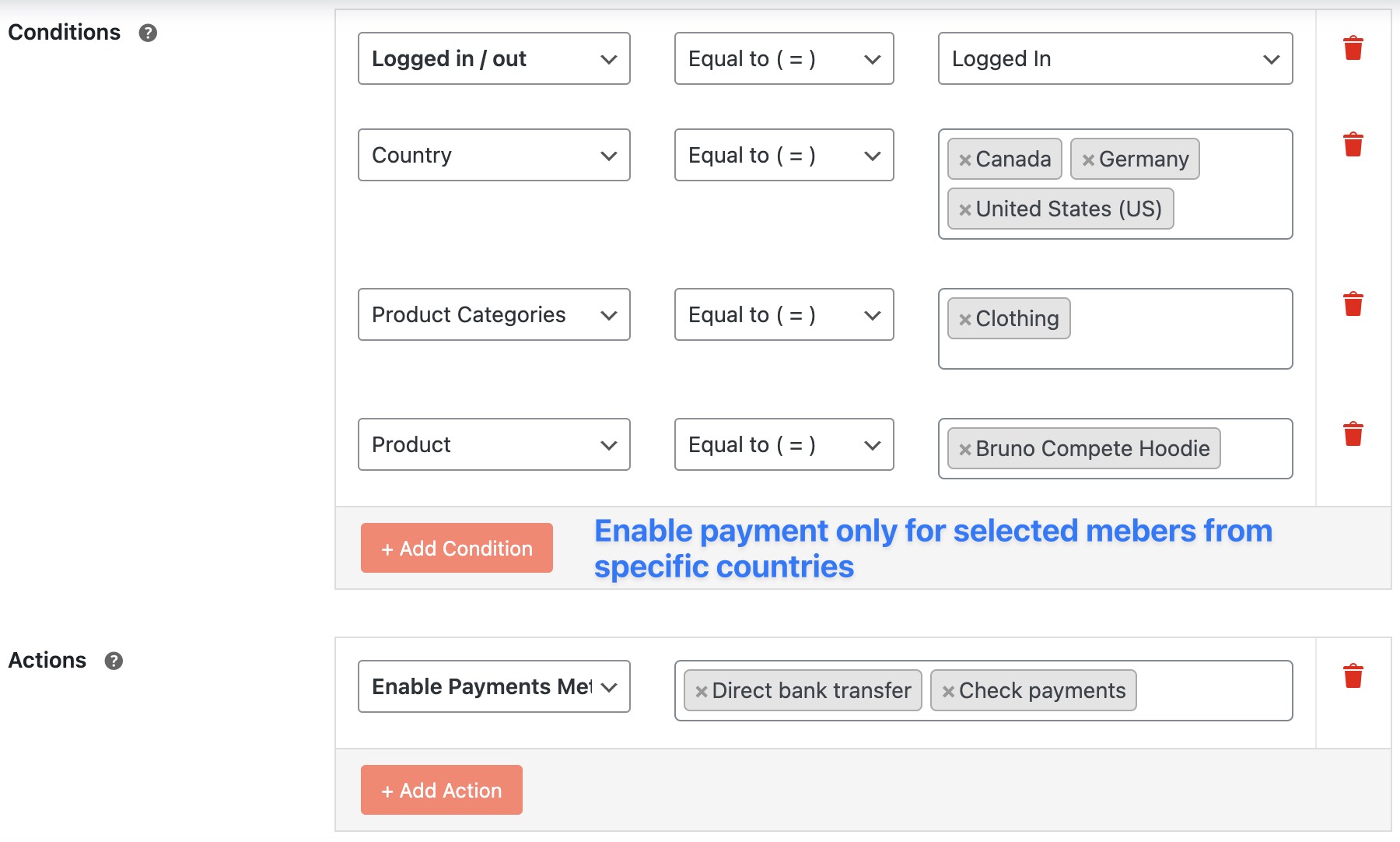

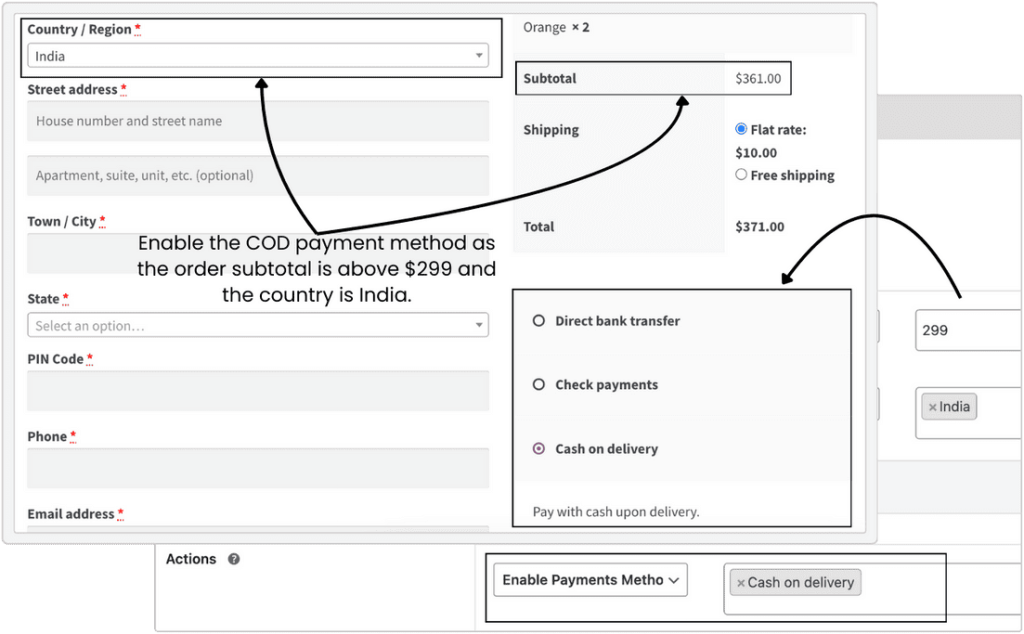

Tailor the checkout experience to customer-specific needs by enabling relevant payment methods based on predefined conditions.

Easily customize payment options within specific rulesets to match your business requirements, ensuring that each customer sees only the most suitable payment methods.

By enabling payment methods for particular customer attributes, cart conditions, or shipping information, you can streamline checkout and enhance the relevance of payment choices.

- Allow guest users access to only a subset of payment methods while providing additional options for logged-in customers.

- Enable specific payment gateways for high-value carts or restrict payment methods for carts with a certain number of items.

- Activate region-specific payment options based on billing or shipping address fields for smoother order processing.

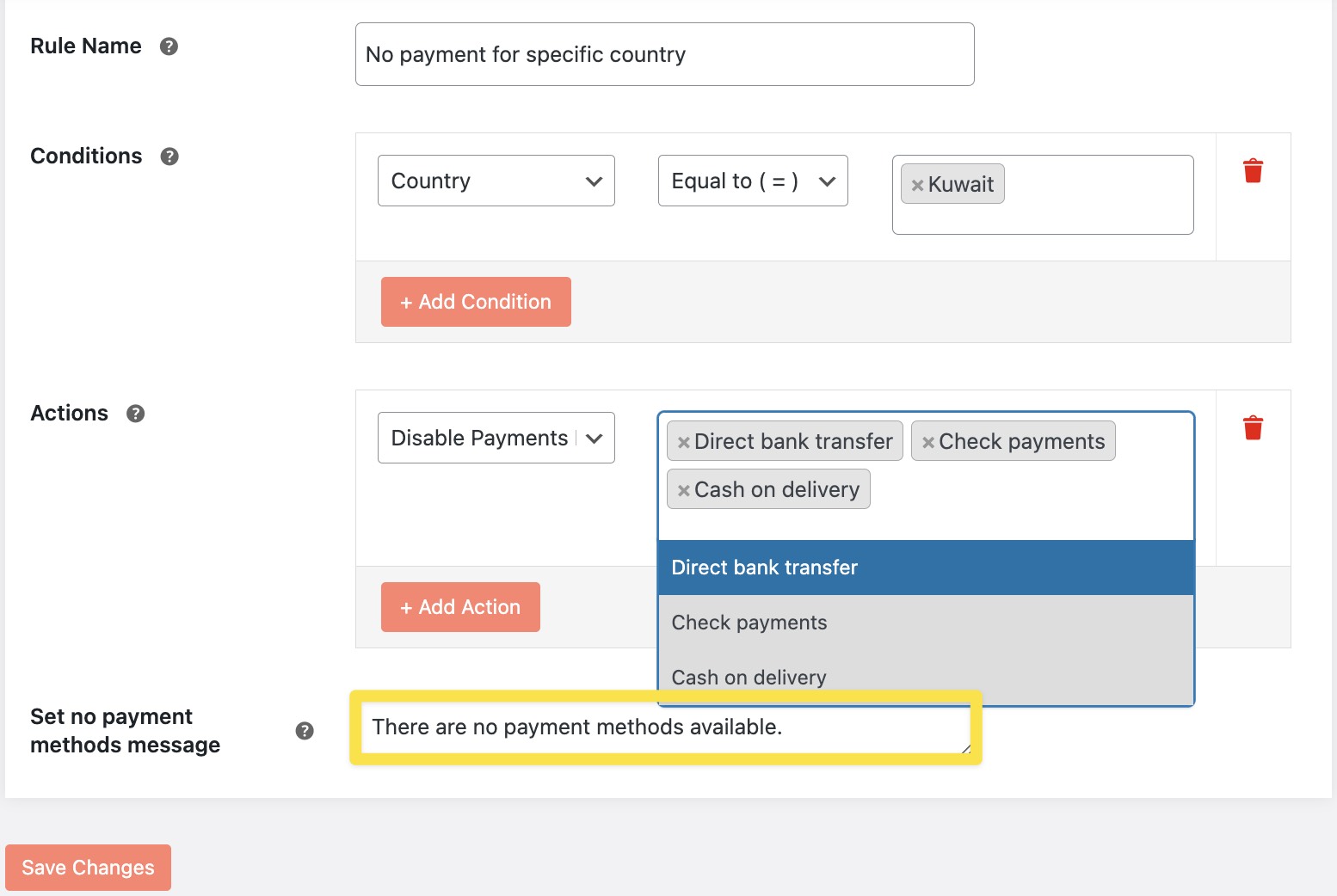

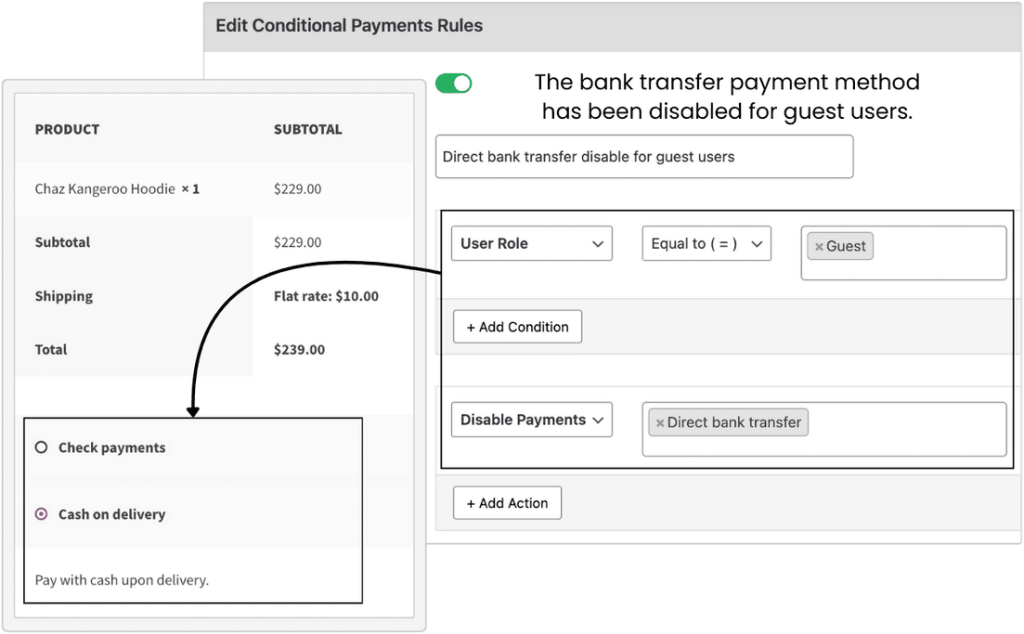

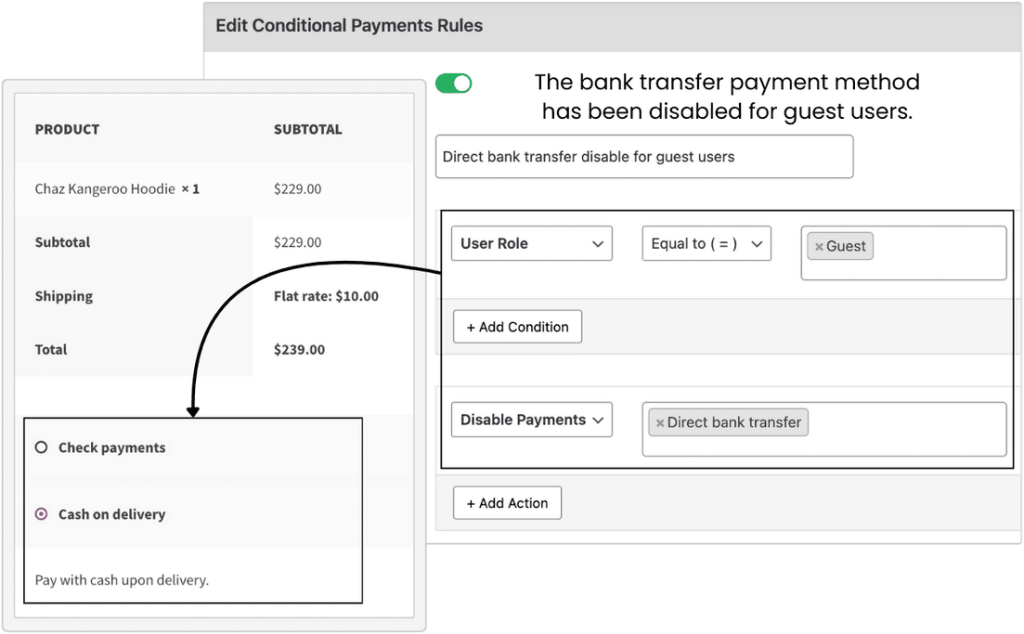

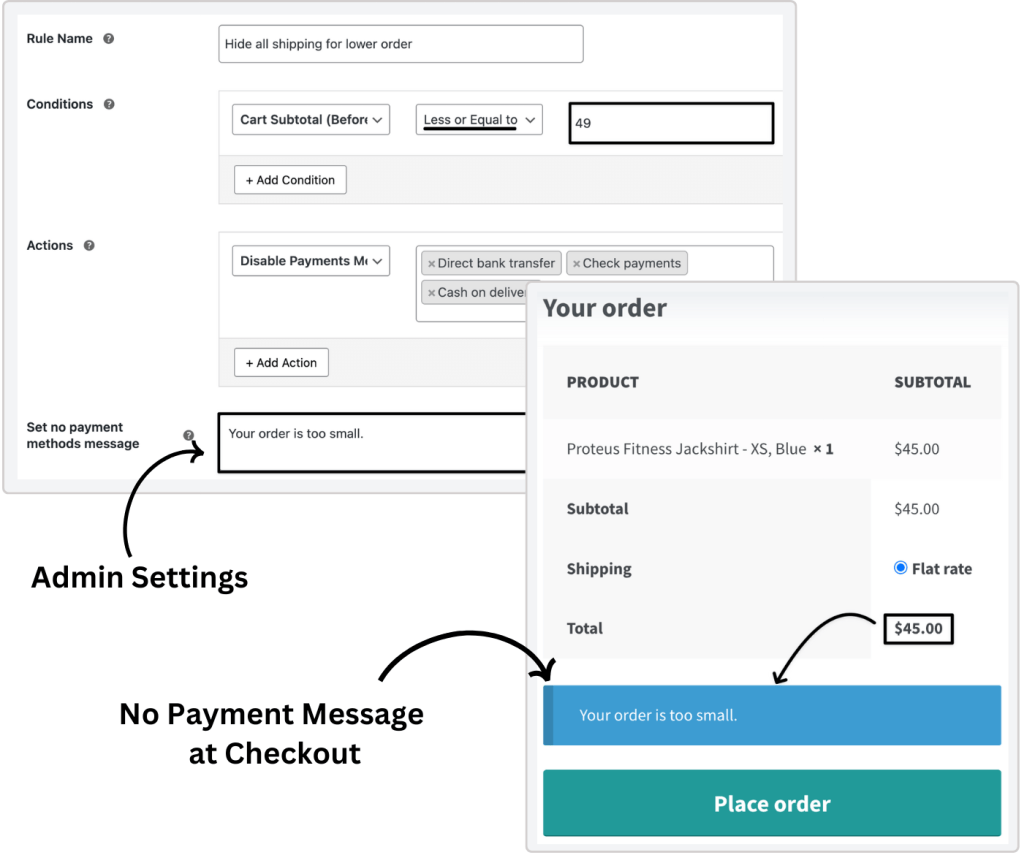

Refine the checkout process by disabling relevant payment methods based on the various conditions, enhancing relevance.

With the ability to disable payment methods within particular rulesets, you can streamline the checkout experience, reduce fraud risk, and tailor available payment options for each transaction.

By deactivating payment methods for specified customer attributes, cart conditions, or billing details, you ensure that only the most appropriate options are presented to each customer.

- Restrict certain payment methods for guest users, reserving sensitive options like bank transfers for logged-in customers.

- Limit region-specific payment options, such as Cash on Delivery, to particular billing or shipping countries.

- Disable high-risk payment methods for carts containing specific items or exceeding set subtotal thresholds.

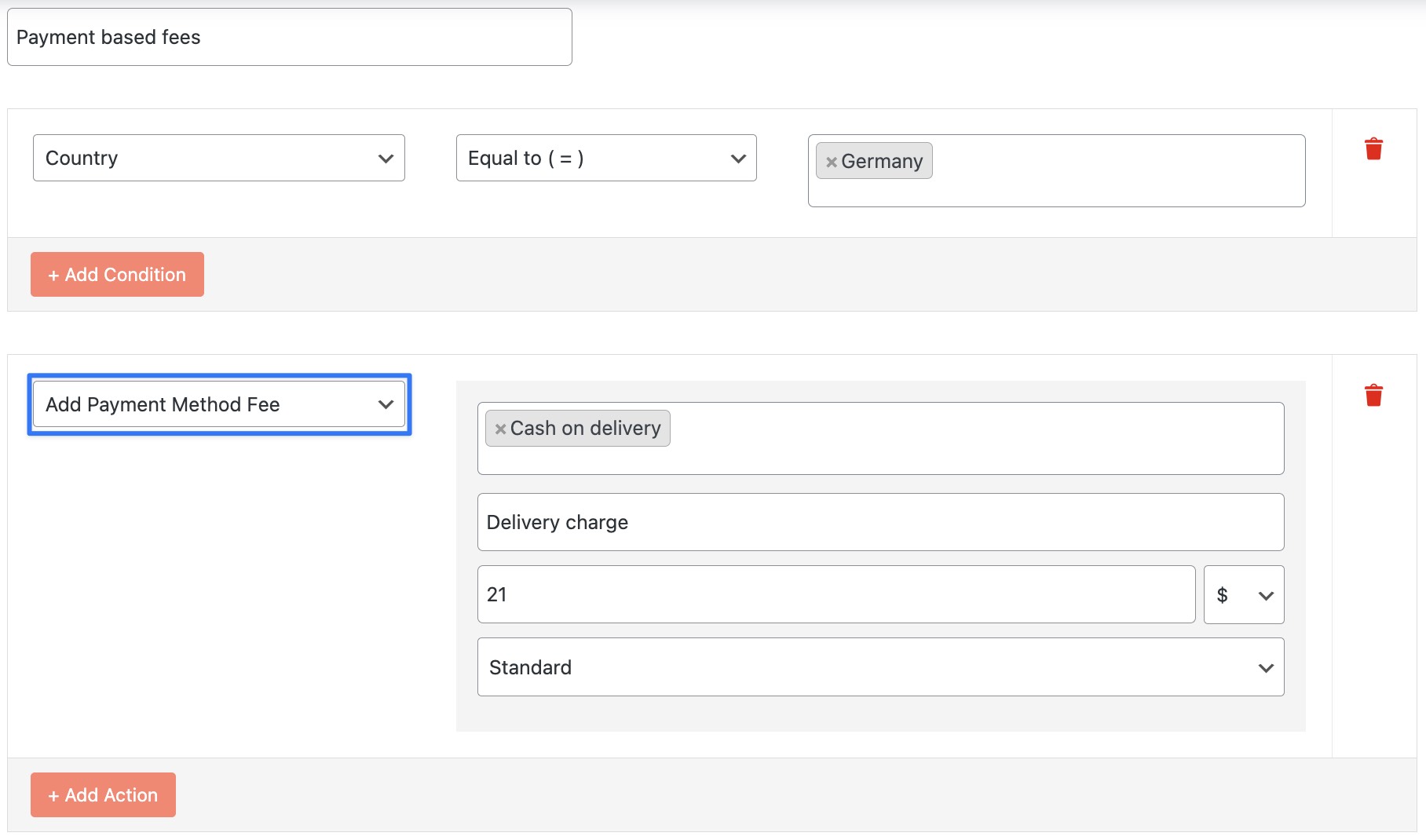

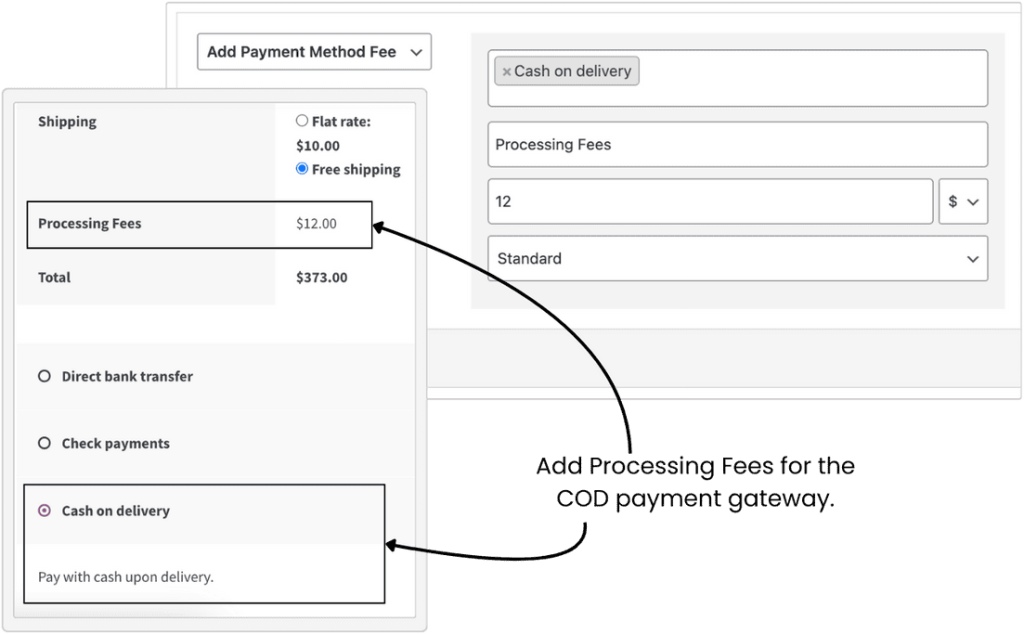

Optimize transaction costs and enhance transparency by applying customizable fees to specific payment gateways under defined conditions.

This feature allows you to add fees to particular payment methods, such as an additional $10 for PayPal, based on various conditions. Fees can be configured to apply based on criteria like cart total, billing country, or specific products in the cart.

With customizable and condition-based fees, you can effectively manage transaction costs while clearly displaying all additional charges during checkout.

- Add a small fee for PayPal transactions when the cart total is below a certain amount to offset processing costs.

- Apply regional fees to specific payment methods for customers in high-risk billing countries.

- Charge an additional fee for particular products or product categories to cover additional costs associated with payment method handling.

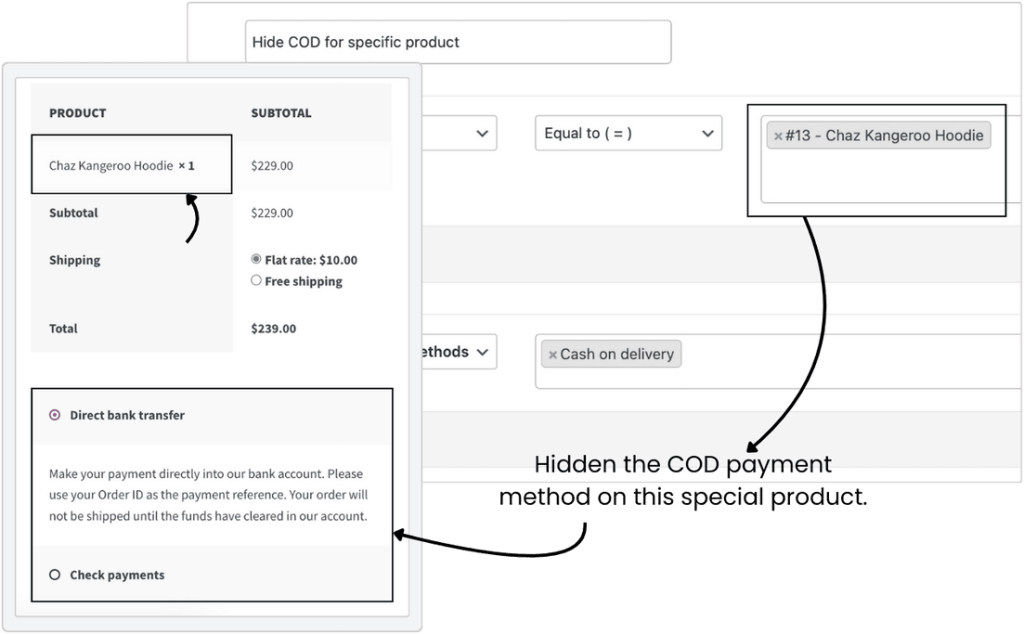

Customize the checkout experience by controlling payment options for individual products, ensuring each product aligns with your business goals.

Product-specific conditional payment rules provide the flexibility to tailor available payment methods for each product based on unique attributes.

This feature enables a personalized checkout process, allowing you to restrict or enable payment options based on product-specific criteria like category, tags, quantity, stock status, and more.

- Limit Cash on Delivery for high-value electronics by setting product-specific rules for this category.

- Enable PayPal exclusively for variable products with certain attributes, like specific sizes or colors.

- Customize payment options for product bundles by applying rules to grouped products, simplifying checkout for these configurations.

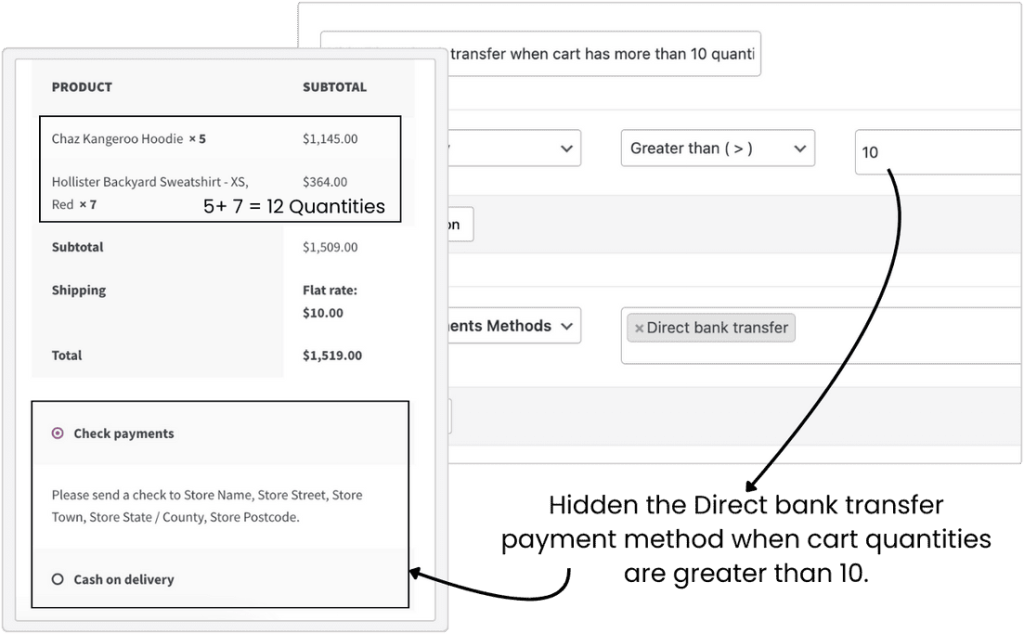

Enhance checkout control and flexibility by setting payment options based on cart-specific attributes for a seamless customer experience.

Cart-specific conditional payment rules allow you to modify available payment methods based on the cart’s overall attributes, such as subtotal, quantity, weight, volume, and more.

Easily apply conditions to align payment options with specific cart configurations, providing an optimized checkout process that caters to unique order characteristics and business goals.

- Restrict certain payment methods like Cash on Delivery for carts with a subtotal below a set amount before discounts.

- Limit payment options for carts containing more than a specified number of items to streamline processing.

- Apply specific payment methods to oversized items by setting rules for their shipping class.

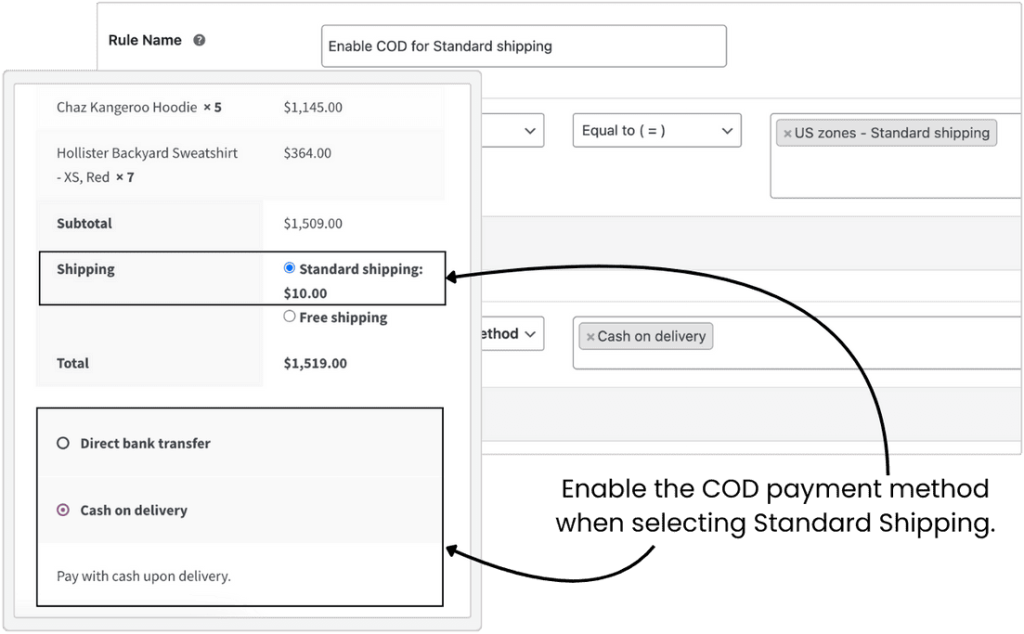

Align payment options with chosen shipping methods to provide a more customized checkout experience.

Shipping-specific conditional payment rules let you tailor available payment methods based on the selected shipping method.

By aligning payment options with shipping choices, you can ensure that each transaction remains secure and relevant to the customer’s preferences.

- Enable only secure payment options like credit cards for premium or expedited shipping methods.

- Allow Cash on Delivery exclusively for standard shipping to manage cash flow and reduce risk.

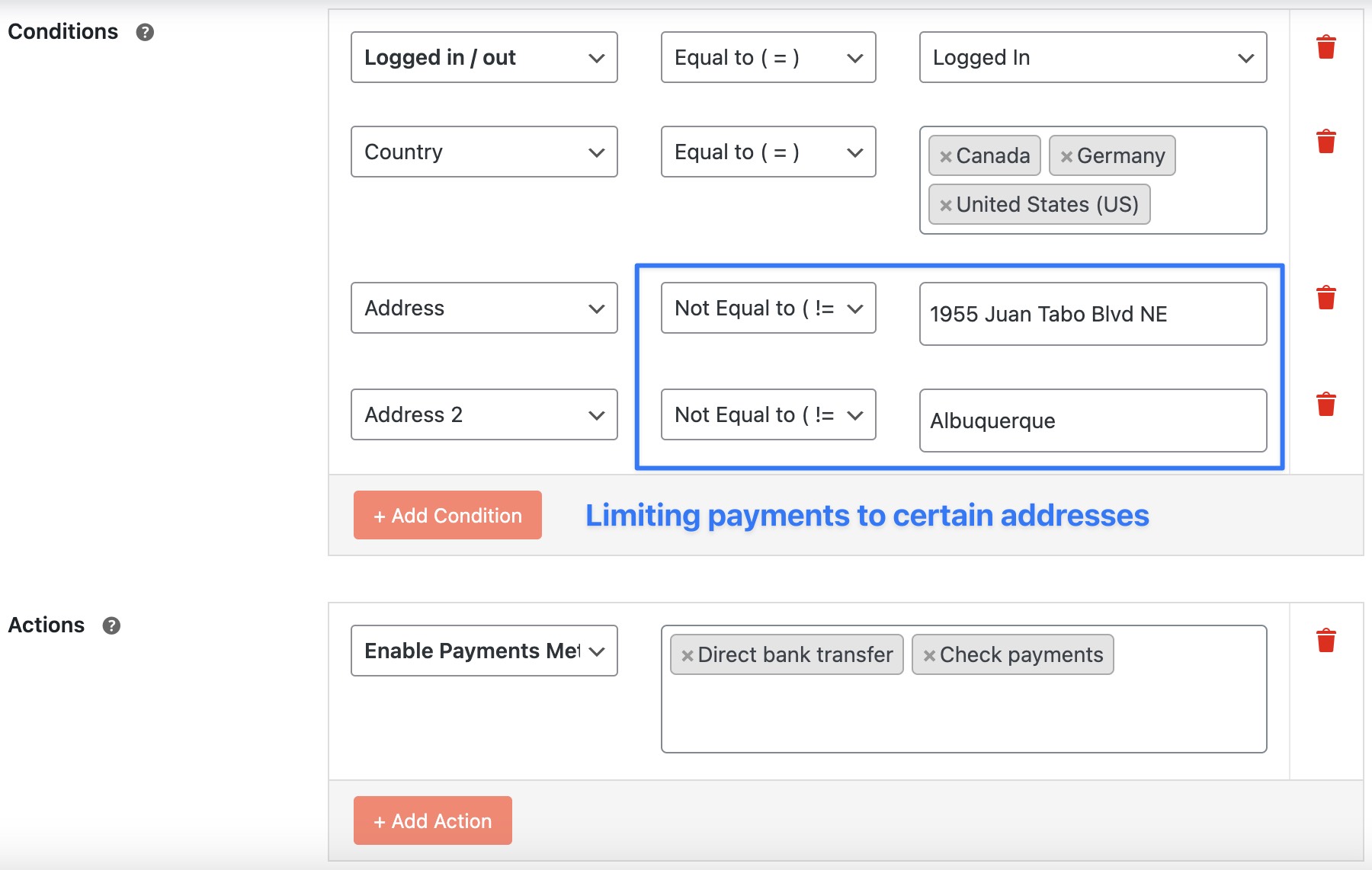

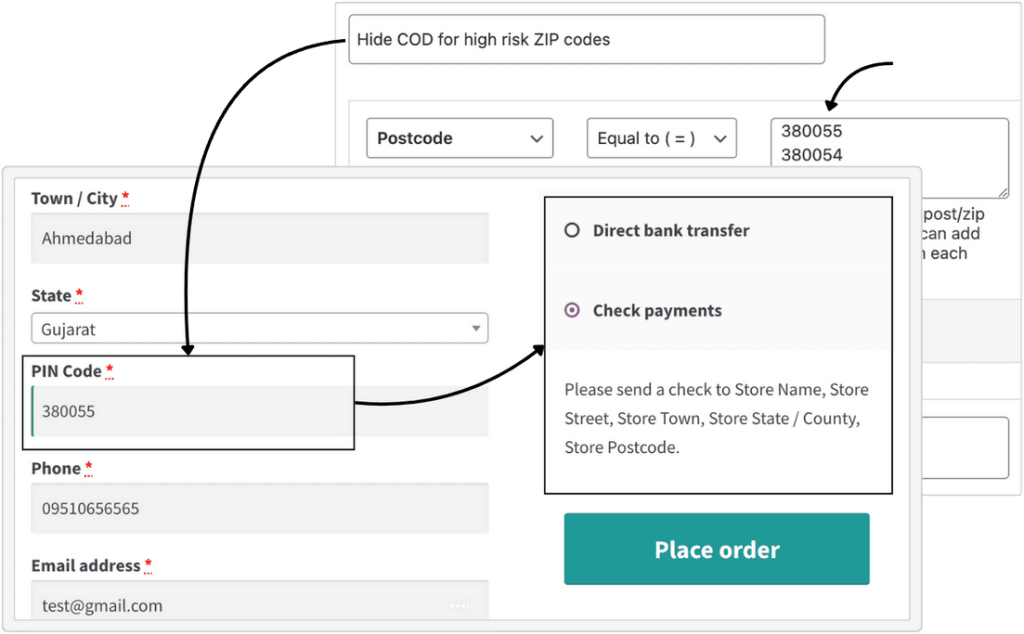

Enhance security and minimize fraud risks by customizing payment options based on the billing or shipping information.

Billing or shipping field-related rules allow you to restrict payment methods according to various customer billing and shipping details, creating a more secure and tailored checkout experience. By limiting payment options based on customers’ locations and attributes, you can effectively mitigate risks associated with fraudulent transactions.

Utilize fields such as first name, last name, company, address, country, city, and postcode to refine payment method availability.

- Disable cash on delivery for customers in postcodes linked to high delivery fraud rates, reducing potential financial losses.

- Enable only secure payment methods like PayPal or enhanced credit card payments for customers billing from countries with lower fraud rates.

- Customize payment methods for specific cities or regions based on previous risk assessments or service availability.

Personalize the checkout experience by tailoring payment options based on individual customer attributes.

Customer-specific conditional payment rules allow you to customize payment methods according to unique customer characteristics, such as login status, user, or user roles.

With these rules, you can offer a more tailored payment experience, providing customers with the most relevant payment options based on their status and relationship with your store.

- Offer exclusive payment options for logged-in customers, while providing standard options for guest users.

- Distinguish payment options based on customer roles (e.g., wholesale vs. retail). For example, wholesale clients may access bulk payment options, while retail customers see standard payment methods.

Increase checkout flexibility by adjusting payment options based on specific days or times for a responsive payment experience.

Time-specific conditional payment rules allow you to modify available payment methods based on particular timeframes. This feature supports dynamic adjustments to payment options, whether by day of the week, specific dates, or times of the day.

With time-based rules, you can create exclusive payment offerings during peak times or promotions and streamline options during off-peak hours.

- Activate faster or more secure payment options during peak hours and limit payment options after business hours to streamline checkout.

- Enable special payment methods on weekends to encourage purchases while limiting certain methods during weekdays for better operations.

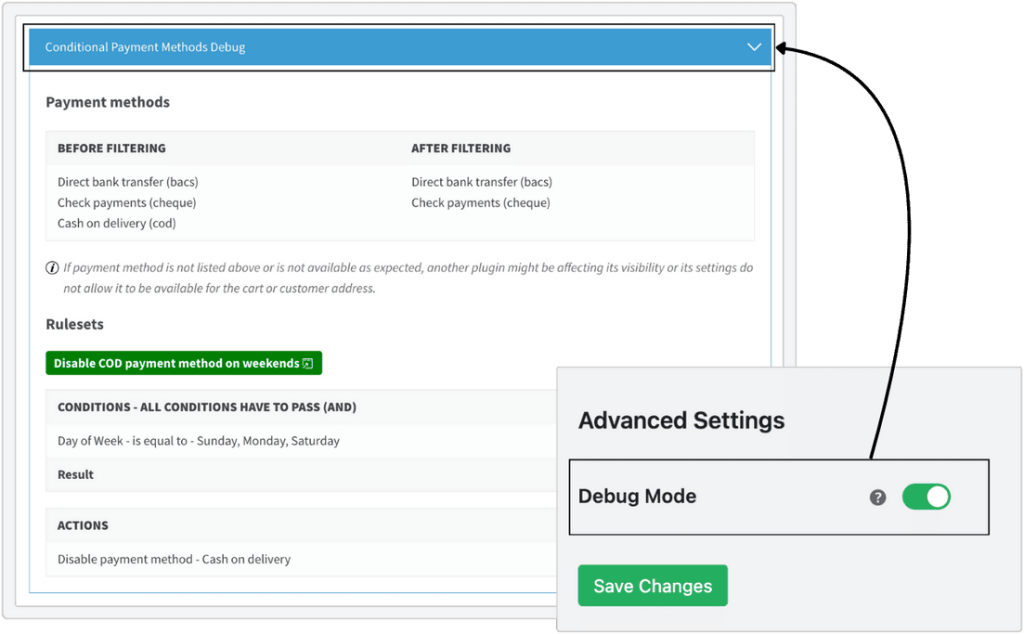

Enhance troubleshooting and optimization of your payment rulesets with real-time visibility into their performance on the checkout page.

Enabling debug mode allows you to thoroughly examine the conditions set within your rulesets and monitor their real-time outcomes on the checkout page.

This feature provides detailed feedback on each condition, allowing for immediate insights into the effectiveness of your rulesets.

- During checkout, debug mode shows information on rules and conditions, including which are evaluated, their outcomes, and their impact on the ruleset.

- Each condition features a clear pass or fail status, helping you quickly identify which conditions are not being met or which are functioning correctly.

- View all active rulesets in one place for easy review of configurations and dependencies, ideal for complex checkout processes with multiple rulesets.

Allows you to display a tailored message when a payment method is not available. This improves user experience by providing clear guidance during checkout.

- Customize messages for unavailable payment methods to inform customers.

- Example: Display “Credit Card payments are temporarily unavailable. Please use PayPal” to guide users smoothly.

Extraordinary Features at

an Affordable Price

1 Year of updates & support

All licenses billed annually

PERSONAL

$99/

yr.1 site

Great for Website Owners with a single WooCommerce Store

BUSINESS

$299/

yr.5 site

Great for businesses with multi-site installations or multiple stores

AGENCY

$499/

yr.30 site

Great for agencies or WooCommerce website developers

- Version: 1.2.2

- Last Updated: March 20, 2025

- WordPress: 6.7.x

- WooCommerce: 9.7.x

- View Changelog

What Sets Us Apart?

Frequently Asked Questions

-

Yes, it’s fully compatible with some popular payment gateways such as WooCommerce Stripe, WooCommerce PayPal Checkout, WooCommerce PayFast Gateway, Braintree for WooCommerce Payment Gateway, etc.

-

Yes, you can add multiple conditions and actions per rule.

-

Yes, it works just fine with the Flat Rate Shipping plugin.

-

Yes, you can restrict payment methods by billing or shipping fields such as first name, last name, address, etc.

-

Yes. All of this is very easy to do with our plugin.

-

Our Conditional Payments for WooCommerce plugin has checked compatibility with the following plugins.

- WPML

- WeGlot

- Table Rate Shipping Method for WooCommerce

- CURCY – Multi Currency for WooCommerce

- WooCommerce High-Performance Order Storage (HPOS)

- WooCommerce Block-Based Checkout (New Cart and Checkout Blocks)

- All Dotstore Plugin Compatible with a Conditional Payments plugin