Table of Contents

The choice of your WooCommmerce store’s payment gateway is a strategic decision that significantly shapes user experience, trust, and conversion rates.

A swift, reliable, and easy-to-use payment gateway can streamline the checkout process — reducing cart abandonment and maximizing store profitability.

Contrarily, a hard-to-navigate or unreliable option may frustrate customers and deter them from completing their purchases.

In this comprehensive guide, we’ll delve into the critical factors you should consider when choosing a payment gateway for WooCommerce store to ensure a seamless shopping experience for your customers.

Factors to Consider When Choosing a Payment Gateway for WooCommerce

When choosing a payment gateway for WooCommerce, examine a few key points: security, fees and charges, supported payment methods, WooCommerce compatibility, and ease of setup and management.

1. Security

In an era of increasing online transactions and equally growing cyber threats, the security offered by a payment gateway is undeniably significant. A secure payment gateway ensures that all transactions and customer data are encrypted — safeguarding your customers’ confidential financial information.

This protects your customers and bolsters their trust in your WooCommerce store, critical for promoting repeat purchases and customer loyalty.

So, consider a payment gateway, that utilizes advanced security measures like PCI compliance and Secure Socket Layer (SSL) encryption.

2. Fees and Charges

Different payment gateways come with various fees and charges, including transaction fees, setup fees, monthly fee, and more. While some payment gateways offer competitive rates for every transaction, others have a tiered pricing model that reduces the transaction fee as your volume increases.

As an online seller, it’s essential to understand and weigh these costs because they can eat into your profits, especially if your store processes high volumes of transactions.

Conversely, lower fees can contribute to higher profit margins. So look for a payment gateway with clear, fair, and manageable pricing.

Future Reading:

What is Flat Rate shipping, its important and how to set it up?

3. Supported Payment Methods

Optimum customer convenience is key to a successful WooCommerce store. Today’s online shoppers use various payment methods, from credit and debit cards to digital wallets such as Apple Pay and PayPal. Even cryptocurrencies such as Bitcoin have entered the scene.

Therefore, a payment gateway must support multiple payment options to cater to diverse customer preferences. Failing to provide popular payment options might result in potential customers abandoning their carts and moving to a competitor’s site.

So ensure your payment gateway provides a wide range of well-known payment options.

4. Compatibility with WooCommerce

To ensure a smooth shopping experience, your chosen payment gateway should seamlessly integrate with WooCommerce. Ill-fitting payment gateways could result in transaction issues, poor user experience, or even loss of sales.

Therefore, opt for payment gateways designed to work hand-in-hand with WooCommerce.

Many renowned payment gateways, such as PayPal and Stripe, are known for their easy compatibility with WooCommerce — ensuring a smooth transaction process from browsing to checkout.

5. Ease of Setup and Management

Lastly, managing an online store already entails various tasks, so dealing with a complicated payment gateway doesn’t need to be one of them. Therefore, an ideal payment gateway should be user-friendly for your customers and easy to set up and manage on your end.

A dashboard allowing easy overview and management of payments, refunds, and disputes can make your life much easier.

Many payment gateways offer plugins specially designed for WordPress and WooCommerce. These plugins will provide a smoother setup process, saving you time and potential headaches.

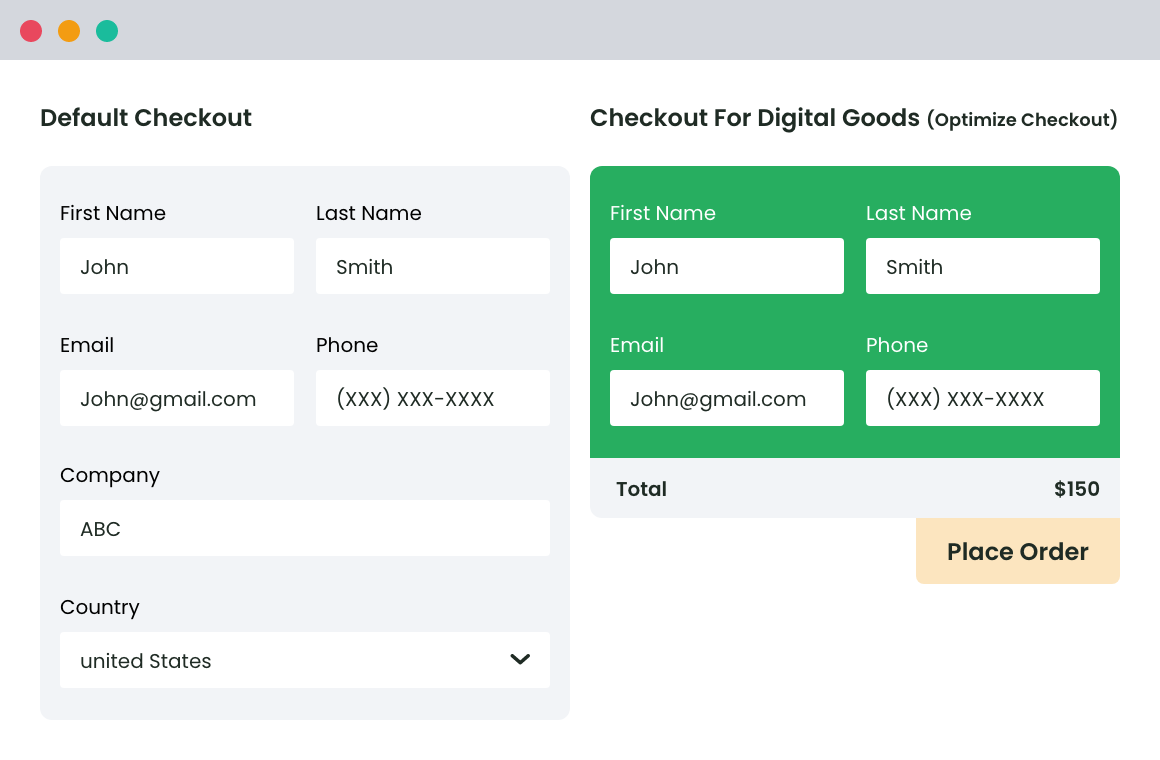

WooCommerce Checkout For Digital Goods

Quick checkout for faster sales and happier customers

14-day, no-questions-asked money-back guarantee.

Best Payment Gateway for WooCommerce Options

Choosing the right payment gateway for WooCommerce is vital for your store. Here are some top options, each offering unique features that cater to different businesses:

1. Stripe

When we talk about a reliable and efficient payment gateway for WooCommerce, we simply can’t overlook Stripe.

Stripe is a comprehensive solution that beautifully blends with the WooCommerce platform.

Seamless Integration with WooCommerce

Stripe offers direct integration with WooCommerce via the WooCommerce Stripe Payment Gateway plugin. This plugin allows you to accept payments directly on your store from various forms of payment, including Visa, MasterCard, American Express, JCB, Diners Club, and even Bitcoin.

It also supports mobile and desktop pay options, including Apple Pay, Google Pay, and Microsoft Pay — offering your customers more flexibility in how they choose to pay.

Cost-Effective Payment Processing

With Stripe, you don’t need to worry about setup fees, monthly fees, or hidden costs. They only charge you when you earn money.

Your earnings are transferred from the merchant account to your bank account on a seven-day rolling basis. This pricing model can be beneficial if you’re starting and running a small to medium-sized e-commerce enterprise.

Why Choose Stripe?

Stripe has several features that make it a great fit as an ideal payment gateway for WooCommerce:

- No Hidden Fees: As mentioned before, Stripe has a transparent pricing model — no setup, monthly, or hidden costs.

- Support for WooCommerce Subscriptions: If you have subscription products (recurring payments) or services in your WooCommerce store, you can rely on Stripe. It integrates well with the WooCommerce Subscriptions extension.

- Customer Convenience: Stripe allows customers to save their cards for future use. This feature significantly simplifies the checkout process for returning customers, as they can use the same card for multiple orders.

- Web Payments API Support: Stripe includes Web Payments API support, allowing customers to pay using payment details associated with their mobile devices in supported browsers, making checkout a few simple taps away.

Stripe is a solid choice due to its seamless integration, flexible payments, and wide range of support.

2. PayPal

PayPal is another reputable and commonly used payment option, that you can consider for your WooCommerce store. It offers a safe and secure payment processing method and is easy to integrate into your WooCommerce store.

Reliable and Trustworthy

PayPal is one of the most recognizable names in digital payments. Its Payments Pro service is widely acknowledged as a secure and reliable payment gateway, inspiring trust in your customers.

The reputation attached to the PayPal brand can heighten customers’ trust in your store and potentially increase sales.

Elastic Payment Options

With PayPal Payments Pro, you can access a fully customizable payment processing solution. It allows your customers to pay through credit/debit cards, bank transfers, phone payments, and in-person payments.

It also offers your customers the chance to buy now and pay later with PayPal Credit, facilitating the purchasing process for your customers while ensuring you get paid upfront.

Why Choose PayPal?

PayPal Payments Pro offers several advantages for WooCommerce store owners:

- Reputation: PayPal is a globally recognized brand, and its presence often instills customer trust.

- Flexible Payment Options: PayPal accommodates various payment methods, from credit cards to bank transfers.

- Integrated Dashboard: PayPal provides a consolidated dashboard to manage all transactions seamlessly.

- Easy Integration: PayPal can be easily integrated with WooCommerce using specific plugins.

Remember, PayPal may have higher fees compared to other payment gateways. Make sure to consider this factor and analyze if the additional cost provides value to your store.

3. Amazon Pay

Amazon Pay stands as a promising payment gateway solution for your WooCommerce store, especially if you’re targeting Amazon’s hundreds of millions of active customers. With a simple setup, it integrates seamlessly with WooCommerce stores.

Familiar and Convenient for Customers

The biggest advantage of Amazon Pay is its familiarity and convenience for Amazon customers. Amazon Pay uses the address and payment information already stored in their Amazon account, which means customers do not need to create a new account or re-enter their billing and shipping information.

This results in a fast, smooth, secure checkout process that your customers will appreciate.

Why Choose Amazon Pay?

There are several reasons why Amazon Pay might be the right choice for your store:

- Ease of Use: Amazon Pay provides a familiar shopping experience to millions of Amazon customers.

- One-Click Checkout: Amazon Pay supports one-click checkout for returning customers, making the purchasing process even more convenient.

- Transparent Pricing Model: Amazon Pay has a clear and straightforward pricing model with no set-up or monthly fees.

- Advanced Fraud Protection: Utilizing Amazon’s advanced security systems, it offers top-tier fraud protection for all transactions.

- Automatic Updates: The Amazon Pay plugin automatically updates to provide enhanced security and performance.

It’s crucial to keep in mind that Amazon Pay may best serve stores that predominantly cater to Amazon’s substantial customer base.

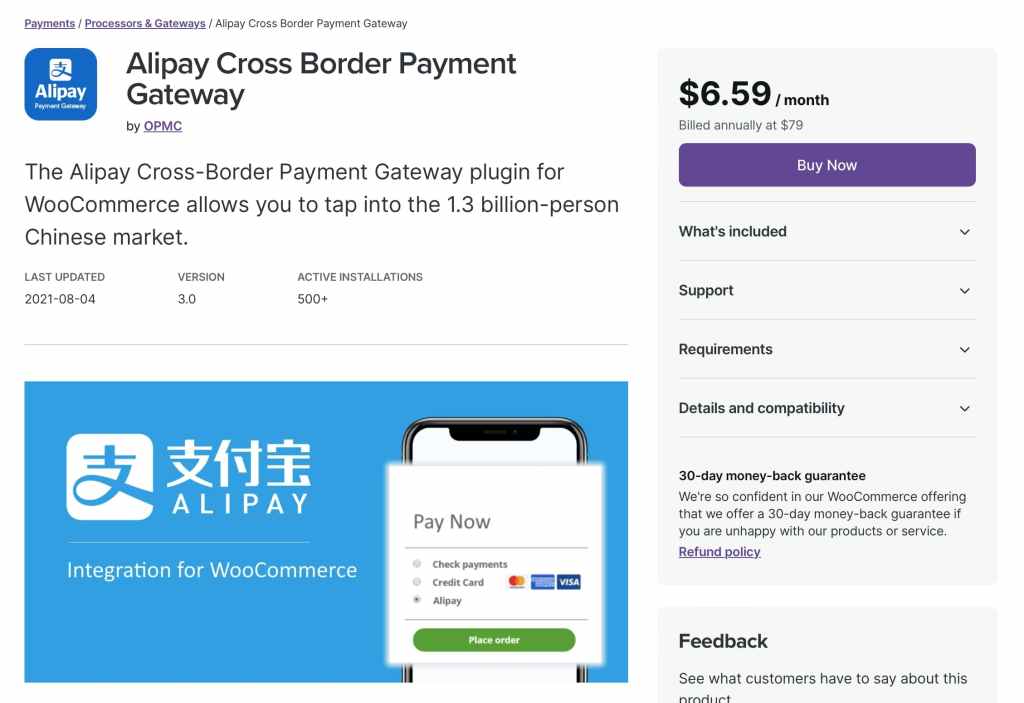

4. Alipay

Alipay is a leading global digital payment platform originating from China. If your WooCommerce store caters to customers in China, deploying Alipay as a payment gateway is a strategic move.

The Alipay Cross-Border Payment Gateway lets you tap into the enormous Chinese market, boasting over 1.3 billion potential customers.

Catering to the Chinese Market

China is a remarkable eCommerce market, and the customer base expands exponentially yearly. Having a payment gateway that’s familiar and trusted by this market can boost your sales and conversions.

By integrating Alipay into your store, you keep things convenient and comfortable for your Chinese customers, as they can stick with what they know best when it comes to accepting online payments.

Why Choose Alipay?

Alipay brings several key advantages to your store:

- Tapping into a Large Market: With Alipay, you gain access to the massive Chinese market, boosting your potential sales and conversions.

- User Trust and Familiarity: Alipay is a trusted name in China’s digital payment landscape, providing customers with a familiar payment method.

- Seamless Integration: The Alipay Cross-Border Payment Gateway smoothly integrates with WooCommerce, simplifying the setup and maintenance process.

- Secure Transactions: Alipay protects your customers’ payment data throughout the transaction, creating a secure shopping environment.

When choosing Alipay as your WooCommerce payment gateway, you should consider that the primary benefit of this payment gateway is its popularity in China. If your business does not have a substantial customer base in this region, other payment gateways might better suit your needs.

5. Braintree

Owned by PayPal, Braintree is a popular payment gateway with robust features and advanced payment options for your WooCommerce store. The Braintree for WooCommerce gateway lets you accept credit cards and PayPal payments.

It offers a host of benefits, including meeting PCI compliance SAQ-A standards, support for WooCommerce Subscriptions and Pre-Orders, secure storage of card information for easier subsequent checkouts, and the processing of refunds, void transactions, and charge captures directly from WooCommerce.

Why Choose Braintree?

Braintree can be a beneficial option for your store for several reasons:

- Acceptance of Multiple Payment Methods: Braintree allows your WooCommerce store to accept payment via Credit Cards and PayPal.

- Enhanced Transaction Processing: The plugin allows for the smooth processing of refunds and also supports void transactions and capture charges.

- Integrated Payments: It seamlessly integrates with your WooCommerce store and supports WooCommerce Subscriptions and Pre-orders.

- Tokenization: Customers can save their credit card details or link a PayPal account for faster and easier checkouts in the future.

Keep in mind that while Braintree provides a range of features, it might not be the best fit for every WooCommerce store. The decision should be based on your store’s requirements, customer base, and the specific features you want from a payment gateway.

6. Skrill

Skrill serves as an international payment gateway with a range of secure online payment options for your WooCommerce store.

The Official Skrill WooCommerce plugin enables your store to accept credit cards, multiple local payment methods, and support for over 80 banks.

Why Choose Skrill?

Skrill offers several advantages for your WooCommerce store:

- Multi-currency support: Skrill’s multi-currency account grants access to over 40 currencies, aiding your store’s growth in international markets.

- Secure payments: High-security standards and anti-fraud technology protect customers’ transactions.

- Seamless customer experience: Skrill’s payment gateway ensures a smooth experience across all devices and does not require user sign-up.

- WooCommerce integration: The Skrill plugin features user-friendly integration, instant settlement, enhanced reporting, and WooCommerce refund capability.

With Skrill’s competitive fee structure (1.2% + €0.29 for credit card transactions and 1% + €0.29 for instant bank transfers), your store can benefit from a cost-effective payment management option.

7. Authorize.net

Authorize.net, a Visa solution, is a substantial and feature-rich payment gateway for e-commerce businesses, including WooCommerce stores.

Being one of the oldest and most trusted payment gateways, Authorize.net allows your store to accept credit card payments, contactless payment form, payments, eChecks, and much more offline and online.

Why Choose Authorize.net?

Consider Authorize.net for your WooCommerce store for several reasons:

- High Level of Security: Authorize.net provides robust security measures, including PCI compliance and advanced fraud detection.

- Seamless Integration: Authorize.net easily integrates into your WooCommerce store, supporting both online and physical sales channels.

- Great for Multiple Business Models: Authorize.net is adaptable to your specific business model and scale, whether you’re a small start-up or a large enterprise.

Consider your store’s specific needs, your target customer base, and the security measures you require before choosing Authorize.net as your WooCommerce store’s payment gateway.

8. Apple Pay

Apple Pay is a convenient and secure payment method designed to simplify the checkout process for customers using Apple devices. By integrating Apple Pay into your WooCommerce store, you can offer a fast and seamless buying experience to shoppers who prefer a one-touch payment solution.

Apple Pay for WooCommerce is available through various payment extensions like WooPayments, Stripe, Square, and others.

Privacy and Security

Apple Pay transactions are protected by advanced security features, ensuring the privacy and safety of customers. All transactions require authentication with Face ID, Touch ID, or a passcode. You can learn more about Apple Pay privacy and security on their official website.

Why Choose Apple Pay?

Integrating Apple Pay into your WooCommerce store offers several benefits:

- Fast and Simple Checkout: Apple Pay allows one-touch payments on compatible devices, streamlining the checkout process.

- Increased Conversion Rates: A better checkout experience can lead to higher conversion rates for your store.

- Privacy and Security: Apple Pay transactions are protected with advanced security features and authentication.

- Multi-talented Payment Solution: Apple Pay supports multiple use cases like delivery, click and collect, and subscriptions.

Incorporating Apple Pay into your WooCommerce store can lead to an improved shopping experience for your customers, potentially increasing conversion rates and enhancing the overall security of your payment processing.

Comparing the Options for Top Payment Gateway for WooCommerce

Here’s a comparison table of the payment gateways so that you have an overview of each gateway’s functionalities:

| Payment Gateway | Benefits | Notable Features |

| Stripe | Seamless integration, flexible payments, support for WooCommerce Subscriptions | No hidden fees, Web Payments API support, customer convenience with saved cards |

| PayPal | Reputation, flexibility, buy now pay later options | PayPal Credit, integrated dashboard, easy integration with WooCommerce plugins |

| Amazon Pay | Familiarity for Amazon customers, advanced fraud protection | One-click checkout, transparent pricing model, automatic updates, ease of use |

| Alipay | Access to the Chinese market, user trust and familiarity | Seamless integration, and secure transactions, cater to China’s massive eCommerce market |

| Braintree | Security, acceptance of multiple payment methods (Credit Card & PayPal) | PCI compliance SAQ-A standards, supports WooCommerce Subscriptions and pre-orders, tokenization for easier checkouts |

| Skrill | Supports multiple payment options, multi-currency support | Over 40 currencies, secure payments, and integration with 80+ banks |

WooCommerce Checkout For Digital Goods

Quick checkout for faster sales and happier customers

14-day, no-questions-asked money-back guarantee.

How Does a Payment Gateway Work?

Understanding how payment gateways function is crucial in appreciating their essential role in online transactions.

Here’s a step-by-step rundown of how a payment gateway works:

- Customer checkout: Once customers finalize their purchases and go through the checkout process, they enter their payment details, such as credit or debit card information.

- Data encryption: Upon receiving the customer’s information, the payment gateway encrypts it to ensure safe transmission. Encrypted data is then sent to the merchant’s web server.

- Transaction processing: The merchant’s web server forwards the encrypted details to the payment gateway. The gateway, in turn, routes the data to the customer’s issuing bank or financial institution.

- Customer authentication: The issuing bank verifies the transaction details and authenticates the customer’s account before sending an approval or denial response to the payment gateway.

- Transaction approval or denial: If the transaction is approved, the issuing bank sends the funds to the payment gateway, which then moves the funds to the merchant’s account. If the transaction is denied, the payment gateway informs the customer of the issue, prompting them to try again or use a different payment method.

- Finalization: The transaction is complete once the funds are transferred. The merchant receives a notification, and the order can be securely fulfilled.

This entire process happens within seconds, ensuring a smooth and efficient shopping experience for online customers.

Why You Should Use Multiple WooCommerce Payment Gateways

Using multiple payment gateways on your WooCommerce store has several advantages worth considering. These benefits can result in a more satisfying shopping experience for your customers and potentially increased sales revenue for your store:

- Backup option: Should one payment gateway experience technical issues or downtime, having another option enables customers to proceed with their purchases without disruptions, thus preventing lost sales.

- Customer convenience: As different customers have varying preferences for payment methods, providing multiple gateways facilitates a greater demographic reach. It also encourages customers to complete their transactions when they see their preferred gateway.

- International transactions: If your WooCommerce store serves a global audience, offering multiple payment gateways can be crucial for catering to region-specific preferences. Certain gateways also have better transaction fees and currency conversion rates, essential considerations for international customers.

- Risk management: By relying on multiple payment gateways, merchants can mitigate the risks of associating their stores with a sole payment provider. This diversification helps ensure uninterrupted operations even if a gateway encounters transaction problems, fraud management, or compliance issues.

- Optimized revenue: Some payment gateways may partner with specific financial institutions, potentially offering better settlement, transaction, or currency conversion fees. Utilizing multiple gateways enables merchants to route transactions optimally to take advantage of these fee structures, reducing costs and improving revenue.

Setting up multiple WooCommerce payment gateways allows merchants to cover all bases, ensuring a smooth and hassle-free shopping experience for their customers while bolstering both user trust and global reach.

Multiple options also strengthen risk management, enhance savings, and ensure operational continuity even in unforeseen circumstances.

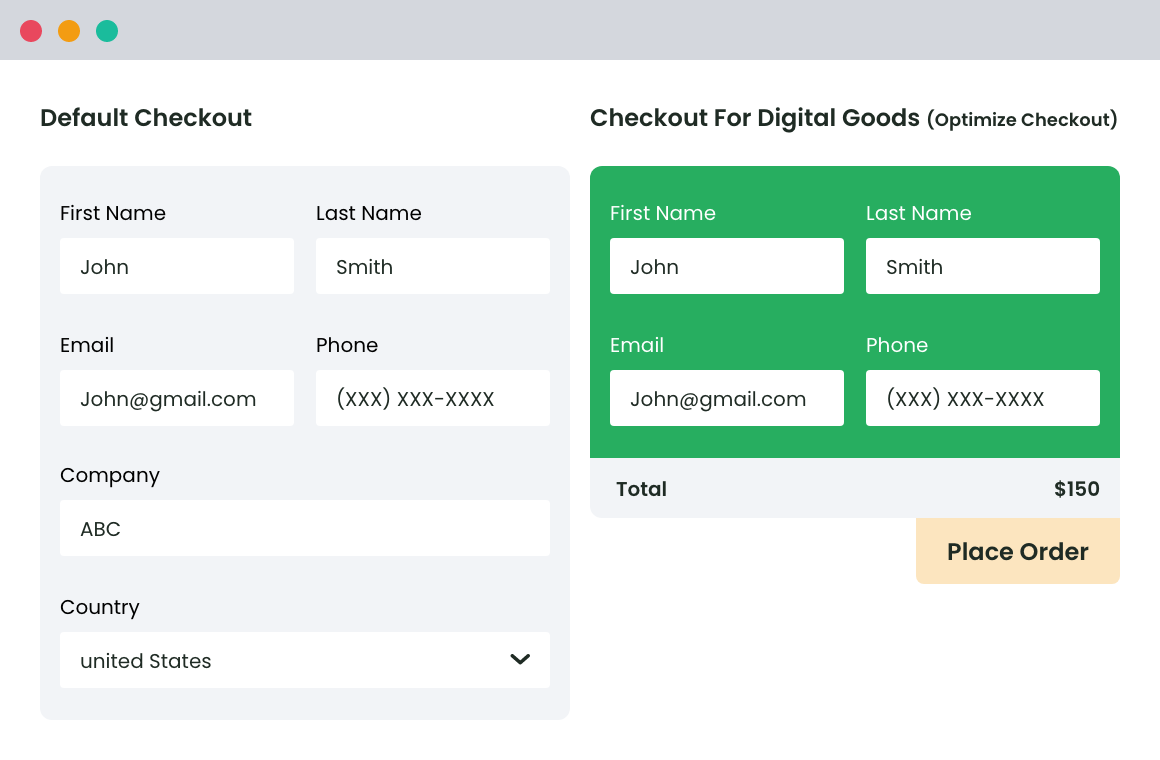

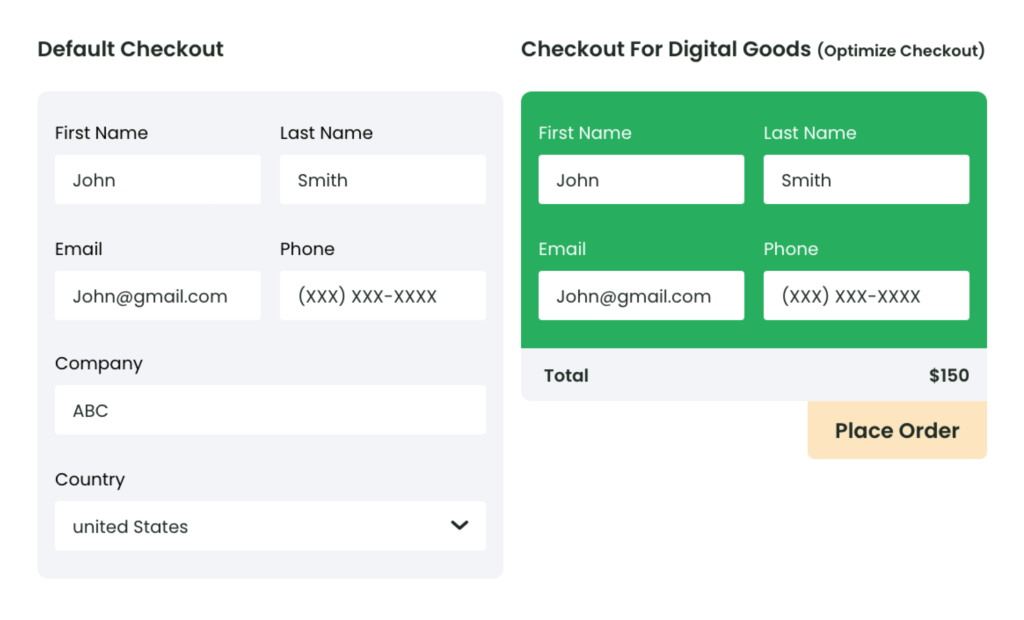

Tips for Optimizing WooCommerce Checkout Experience

Creating a seamless and straightforward WooCommerce checkout experience is paramount to reducing cart abandonment rates and driving conversions.

Once you’ve selected a payment gateway for WooCommerce that aligns with your store’s objectives, you can further optimize your WooCommerce checkout process.

Below are some tips:

- Simplify the Checkout Process: The first rule of making a user-friendly checkout process to keep it simple. Reduce the number of steps or pages a customer must navigate to complete a purchase. You can achieve this by adopting a single-page checkout method. However, if it’s critical to have multiple pages, ensure the process is clear and progress is indicated.

- Optimized for Mobile: With increasing numbers of customers shopping on mobile devices, your checkout process needs to be mobile-friendly. This includes having a responsive design that is easy to navigate on all screen sizes, readable text, and easily clickable buttons.

- Provide Guest Checkout Option: Not everyone wants to create an account to make a purchase. Having a guest checkout option can help attract customers who are in a hurry or are reluctant to share their information. By providing this option, you’ll encourage more customers to complete their checkouts.

- Offer Multiple Payment Methods: As previously discussed, offering multiple payment methods at checkout can ensure that you cater to everyone’s preferences. Let your customers pay the way they’re most comfortable with, whether that’s debit card, credit card, digital wallet, direct bank transfer, or even cryptocurrency.

- Upselling and Cross-selling: Use your checkout page as an opportunity to increase order values. By showcasing related products (cross-selling) or more premium options (upselling), you might encourage customers to add more to their carts.

- Customize the Checkout Page: Customizing the checkout page to match your brand creates a cohesive and professional experience. This customization can be as simple as including your logo and brand colors or as in-depth as altering layouts, fields, and confirmation messages.

- Security Assurance: Particularly on the checkout page, where sensitive customer data is input, display security badges, ratings, or certificates to assure customers that their data is safe with you, thus boosting their confidence to complete their transactions.

Final Words!

Choosing the right payment gateway for WooCommerce store may seem demanding, but considering several essential factors can guide you to the right choice.

That said, an efficient checkout process also plays a vital role. A plugin like WooCommerce Checkout for Digital Goods can streamline your checkout flow, particularly for digital products. By eliminating unnecessary fields, it offers a faster, more efficient checkout experience for your customers.

Ultimately, an optimized WooCommerce store strives to provide a smooth and trustworthy shopping journey to keep customers coming back. With the right payment gateway for WooCommerce and a streamlined checkout process, your store can excel.

FAQs

What payment gateway to use with WooCommerce?

WooCommerce integrates seamlessly with numerous payment gateways, some of the most popular ones include Stripe, PayPal, Square, Authorize.net, and Braintree. The appropriate gateway for your store largely depends on your specific requirements, such as transaction volume, preferred payment methods, geographical location, and more.

How do I choose a payment gateway?

When choosing a payment gateway, consider factors like security capabilities, transaction fees, supported payment methods, ease of integration with your platform, and ease of setup and management. Choosing a flexible payment gateway that supports popular payment methods among your customers is also advisable to ensure convenience.

What are the best high-risk payment processors for WooCommerce?

Finding a reliable payment processor for high-risk businesses can be challenging. However, certain best payment gateways specialize in high-risk transactions and seamlessly integrate with WooCommerce. These include GatewayPros, PayKings, Durango Merchant Services, and eMerchantBroker. Before selecting, research and compare their offerings and consider fees, customer service, and fraud prevention measures.

What is the best payment gateway for my website?

The best payment gateway for your website depends on several factors. Some factors to consider include your transaction volume, associated fees, geographical location & provided currencies, required payment methods, and security measures. Businesses with haigh global traffic may benefit from payment gateways like Stripe or PayPal, known widely for their ease of use and extensive currency support. By contrast, a small business expecting lower transaction volume may prefer a payment gateway with lower or no monthly fees.

WooCommerce Checkout For Digital Goods

Quick checkout for faster sales and happier customers

14-day, no-questions-asked money-back guarantee.