Table of Contents

It is common for payment gateways to charge fees from users. Sometimes it could be as high as 2 or 3 percent of the transaction amount for businesses that accept payments. If your online store were to exclude this amount from customers’ bills, the burden of this expenditure would be on your shoulders.

However, it is totally unnecessary to skip charging the payment gateway or payment method fee from the checkout page.

Buyers do understand that it is a third-party fee and therefore, they do not mind paying it.

So, if you specify the payment gateway fee clearly in the bill and charge it from your customers, it won’t affect your business adversely. In fact, customers will appreciate you for being transparent.

In this blog post, we will explain how you can charge payment gateway fees without making customers feel bad or cheated. Read ahead.

Understanding Payment Gateway Fees

Payment gateway fees are charges associated with processing online transactions through a payment gateway. These fees can vary depending on the payment gateway provider, the type of transaction, and the payment method used.

Understanding payment gateway fees is crucial for businesses to manage their costs and ensure they are not overpaying for payment processing services.

Payment gateway fees can be categorized into several types, including transaction fees, monthly fees, and setup fees. Transaction fees are charged per transaction and can be a flat rate or a percentage of the transaction amount.

Monthly fees are charged for access to the payment gateway’s services, regardless of the number of transactions processed. Setup fees are one-time charges for setting up a payment gateway account.

By understanding these fees, businesses can make informed decisions about which payment gateway provider to choose and how to structure their pricing to cover these costs without burdening their customers.

How Payment Gateways Work

A payment gateway is a service that enables businesses to accept online payments from customers. It acts as a bridge between a website and a payment processor, facilitating the transfer of funds from the customer’s account to the business’s account. Payment gateways work by encrypting sensitive payment information and sending it to the payment processor for verification and processing.

When a customer submits a payment, the payment gateway receives the payment information and sends it to the payment processor. The payment processor then verifies the payment information and sends a response back to the payment gateway, indicating whether the payment was successful or not. If the payment is successful, the payment gateway transfers the funds to the business’s account.

This seamless process ensures that online payments are secure and efficient, allowing businesses to focus on their core operations while the payment gateway handles the complexities of payment processing.

Types of Payment Gateway Fees

There are several types of payment gateway fees that businesses may incur, including:

Transaction fees: These are fees charged per transaction and can be a flat rate or a percentage of the transaction amount.

Monthly fees: These are fees charged for access to the payment gateway’s services, regardless of the number of transactions processed.

Setup fees: These are one-time charges for setting up a payment gateway account.

Refund fees: These are fees charged for processing refunds.

Currency conversion fees: These are fees charged for converting currencies.

Bank transfer fees: These are fees charged for transferring funds to a bank account.

Understanding these different types of fees can help businesses choose the right payment gateway provider and manage their costs effectively.

What do your Buyers Hate about Transaction Fees?

In all probability, the answer is NOT the extra fees itself.

Buyers are, most of the time, fine with reasonable extra fees, like the payment gateway fees being charged in the store for a third-party service provider.

So, if you could convey your reason for charging extra fees properly on the checkout page, there would be no reason for the customers to skip the purchase.

How to make Payment Gateway Provider Fee NOT feel like a burden to Buyers?

Successful deployment of the extra fees on the basis of a payment gateway will save your store from a good amount of spending. Here are the tips to strategically implement extra fees for payment gateways in WooCommerce:

1. Clearly add extra fee details on the checkout page

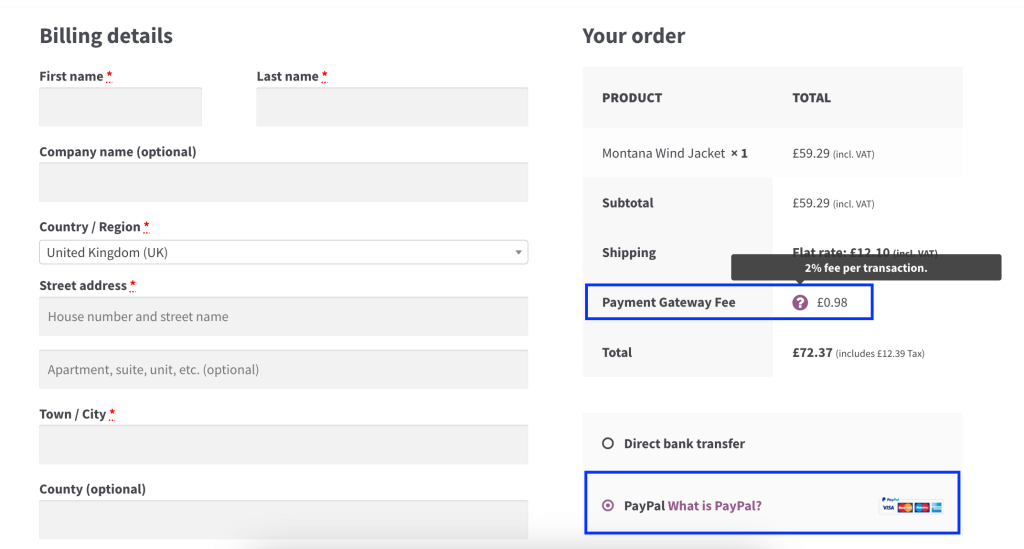

On your cart total or checkout page, your extra fees for the payment gateway must be mentioned clearly. For example, instead of listing or adding directly in other fees, name it Payment Gateway Fee. It will look more reasonable this way.

2. Give a description/reason for this additional fee

Sure that you have given your payment gateway fee a name and clarified things to many buyers already. However, there still could be some people who would want a proper explanation about this fee. A wise store owner will provide them with that.

Here is an example description for your payment gateway fee in a WooCommerce store:

This payment gateway charges users 2% per transaction. It is a third-party fee and is not being applied by our eCommerce store.

Sounds nice and convincing, isn’t it?

3. Don’t fix a random amount but vary it with the payment gateway

With proper description and details about the payment gateway extra fees, a WooCommerce store owner must make sure that the fees don’t look like fake ones to your buyers.

For example, if you charge the same payment gateway fee for a credit/debit card and for PayPal, it may raise eyebrows. It is a well-known fact that there is no fee for eCommerce transactions for buyers if a store uses PayPal.

So, in a hurry, never set the same fixed price for all. Instead, set a genuine payment gateway fee per gateway, as specified by the service providers themselves.

Additionally, consider the maximum fee cap for certain transactions to ensure you are not overcharging your customers.

WooCommerce Extra Fees

Make profits from every confirmed sale through smart, conditional fees.

14-day, no-questions-asked money-back guarantee.

How to Charge Monthly Fees from your Customers?

First of all, install the Extra Fees Plugin for WooCommerce.

How to charge WooCommerce extra fees based on the payment method or shipping method chosen by a customer?

This plugin will save you from the hassles of custom code development and deployment related to charging payment gateway fees, including debit card payments, in a WooCommerce store. Just enable it in your eCommerce store and you are all set to apply a payment gateway surcharge on your buyers!

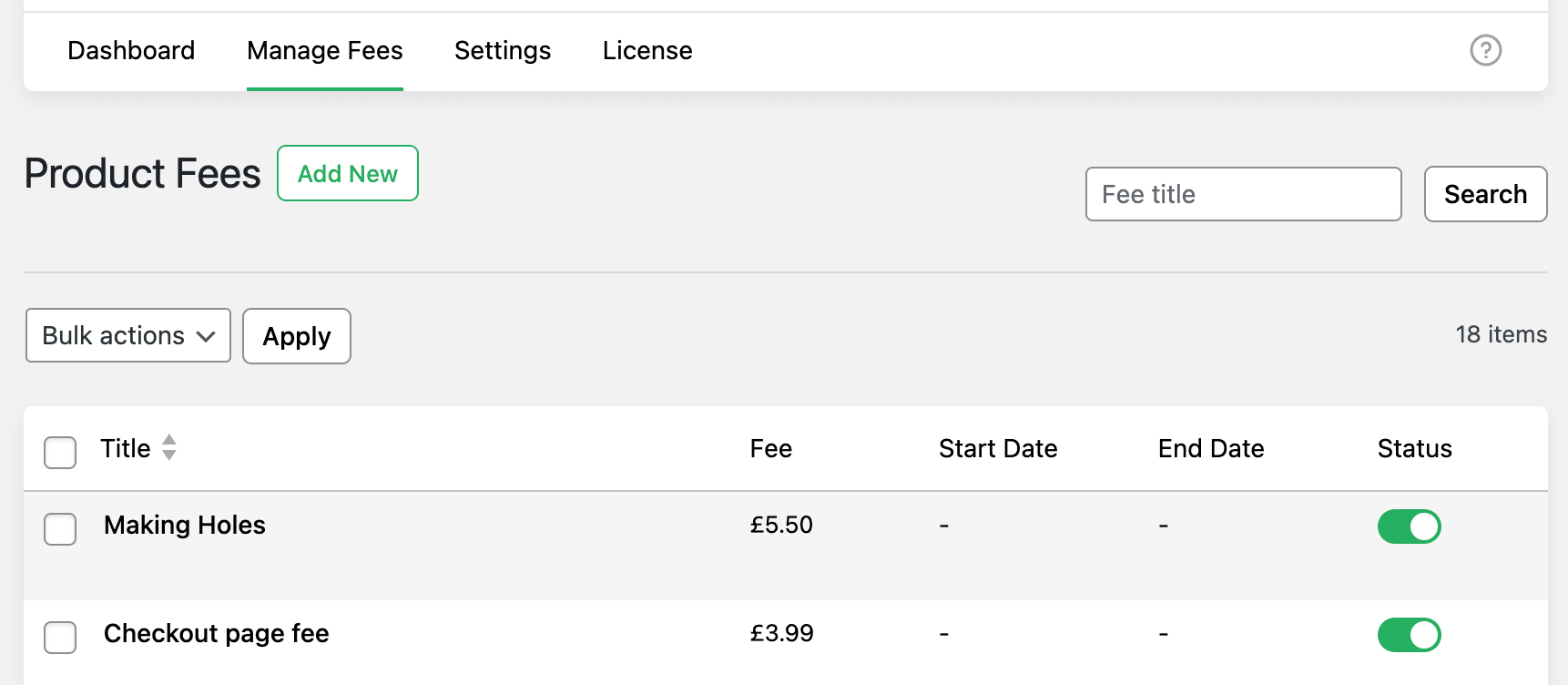

Next, look for the name of this plugin in your admin dashboard and click on it.

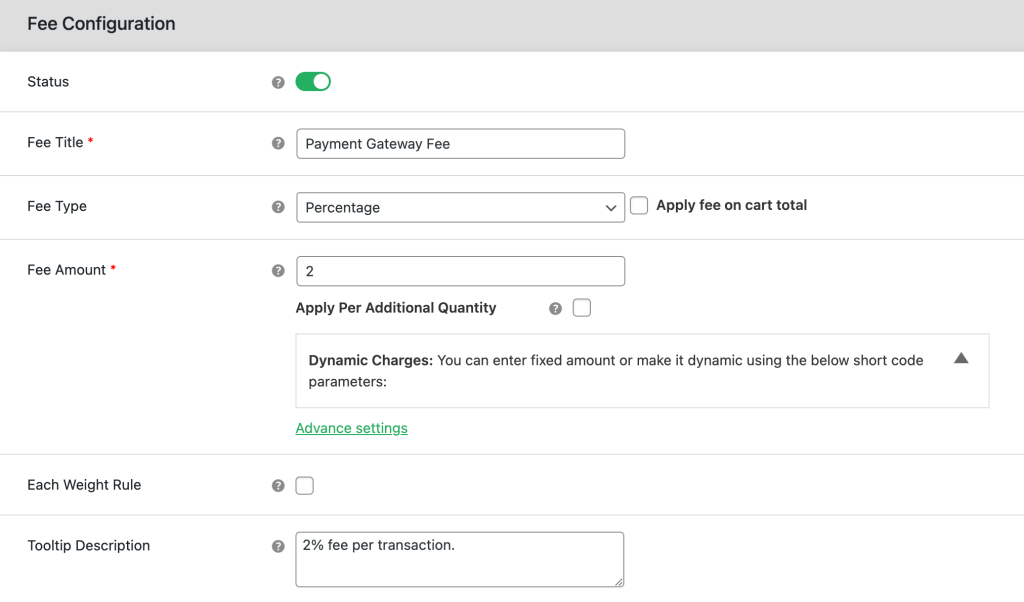

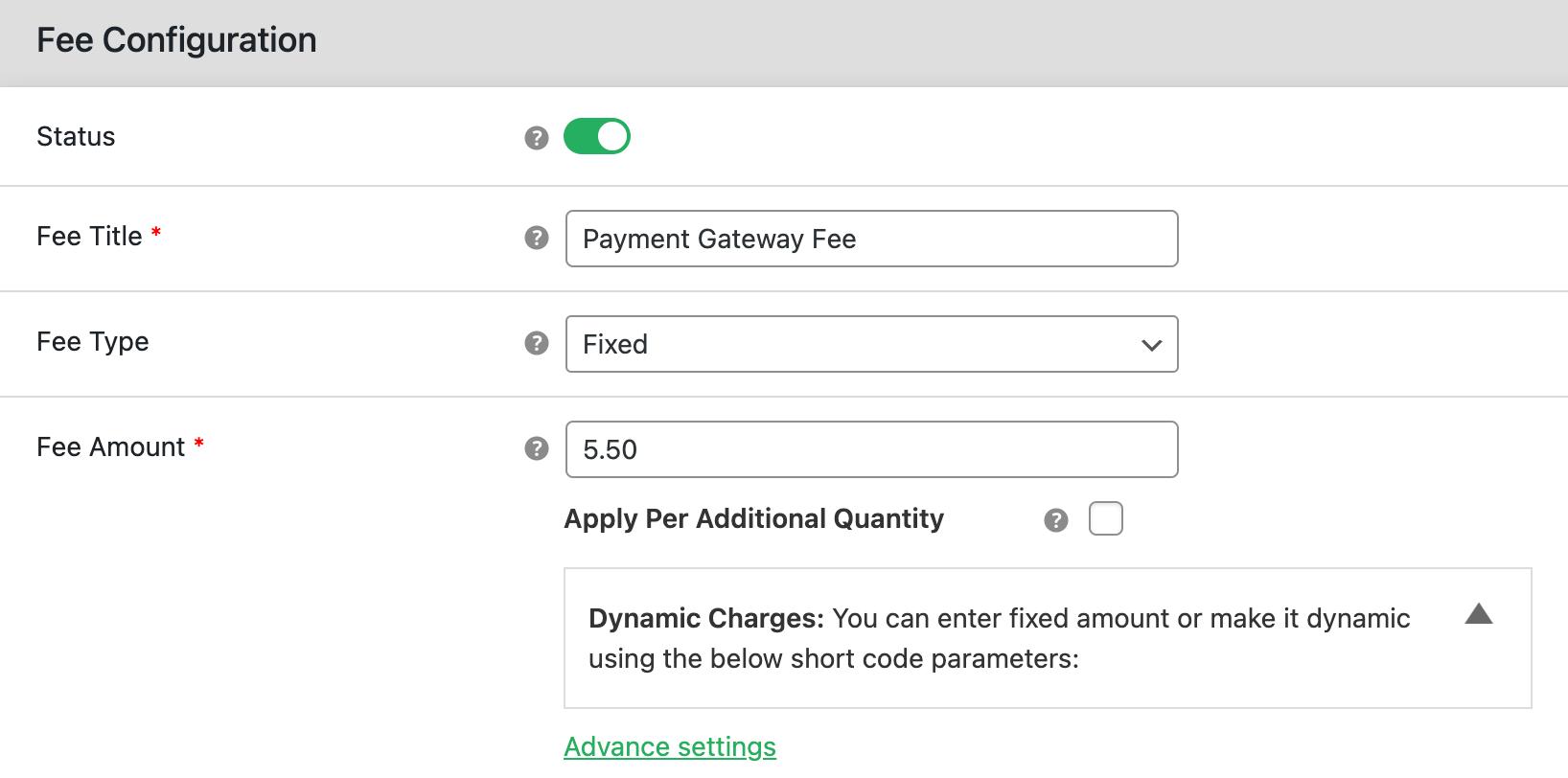

From the opened page, you can click on Add New Fees. Then, fill out the fee configuration form that appears on the next screen.

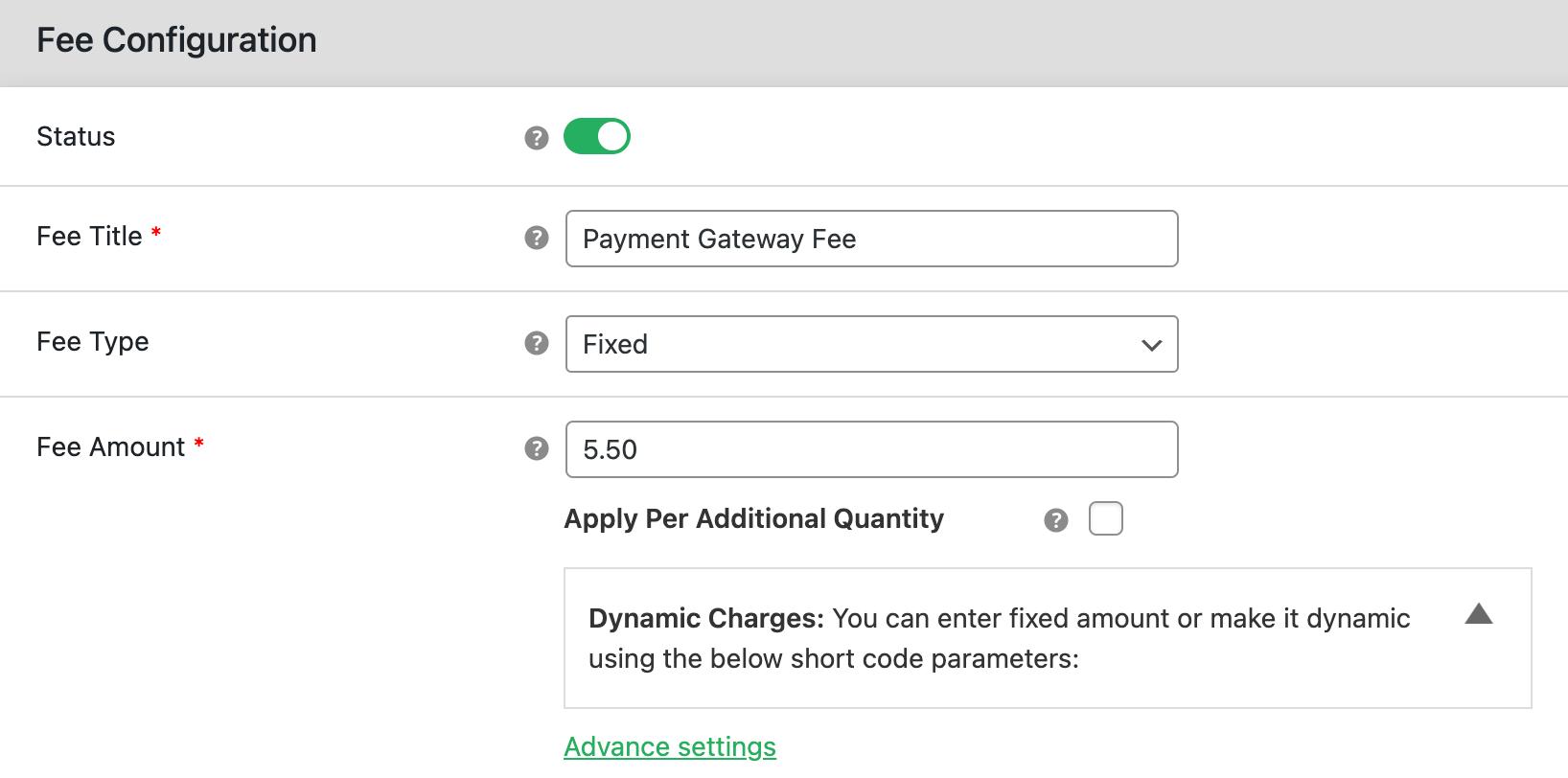

In this form, you need to provide a product fee title and choose a fee type (percentage or fixed amount). Thereafter, write a tooltip description optionally, select a start date & an end date, and specify the amount of the extra fee (in percent or fixed). Only the fields with asterisks are compulsory to be filled.

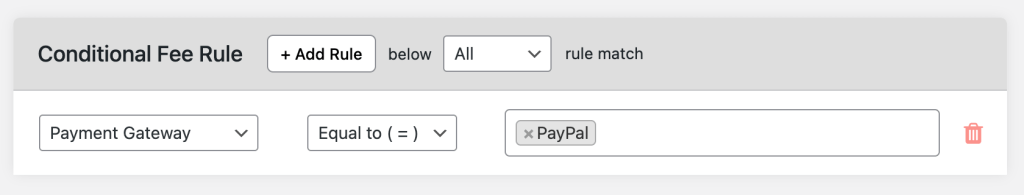

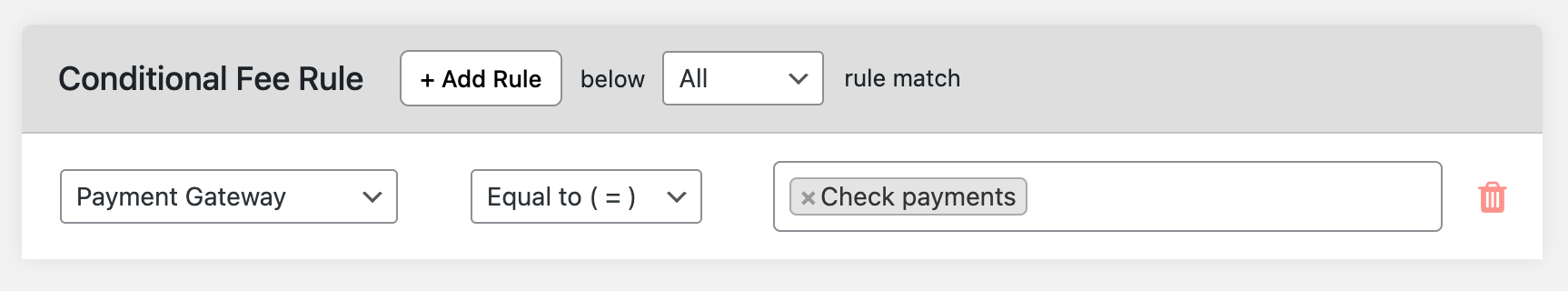

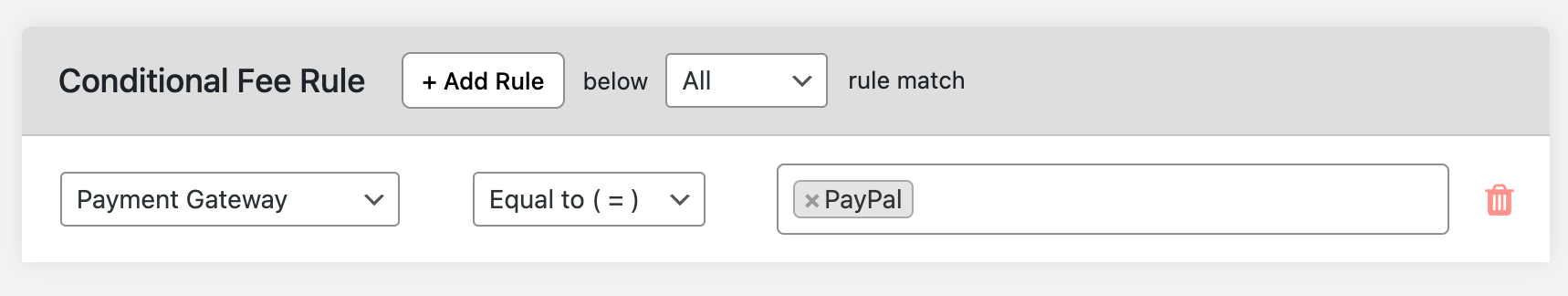

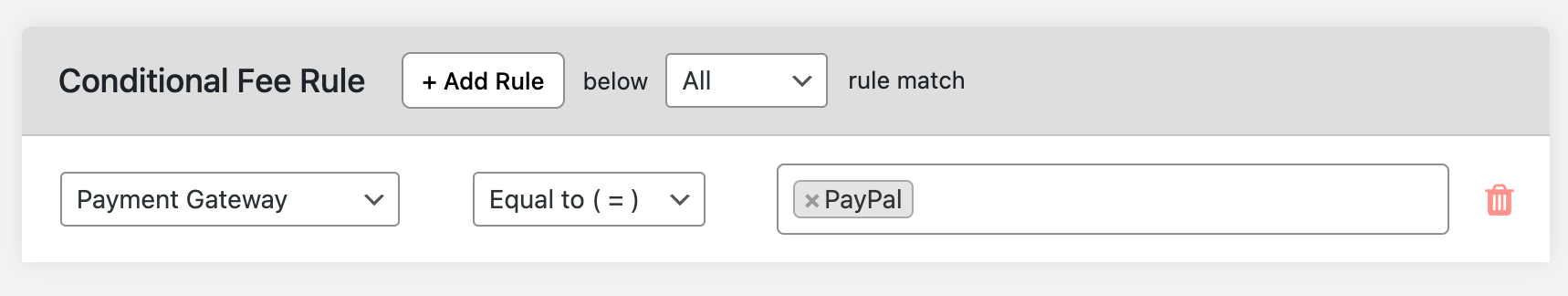

After you fill in all the details in the fee configuration form, scroll down to the Conditional Fee Rule section and choose the conditions as Payment Gateway under the Payment Specific category. In the right-hand side field, choose one or more payment gateways to apply the rule to them.

You can also configure fees for different payment methods, such as bank transfers, which may have different fee structures.

In the same way, you can apply separate extra fees to different payment gateways using the Extra Fees Plugin for WooCommerce, understanding how payment gateways charge various fees.

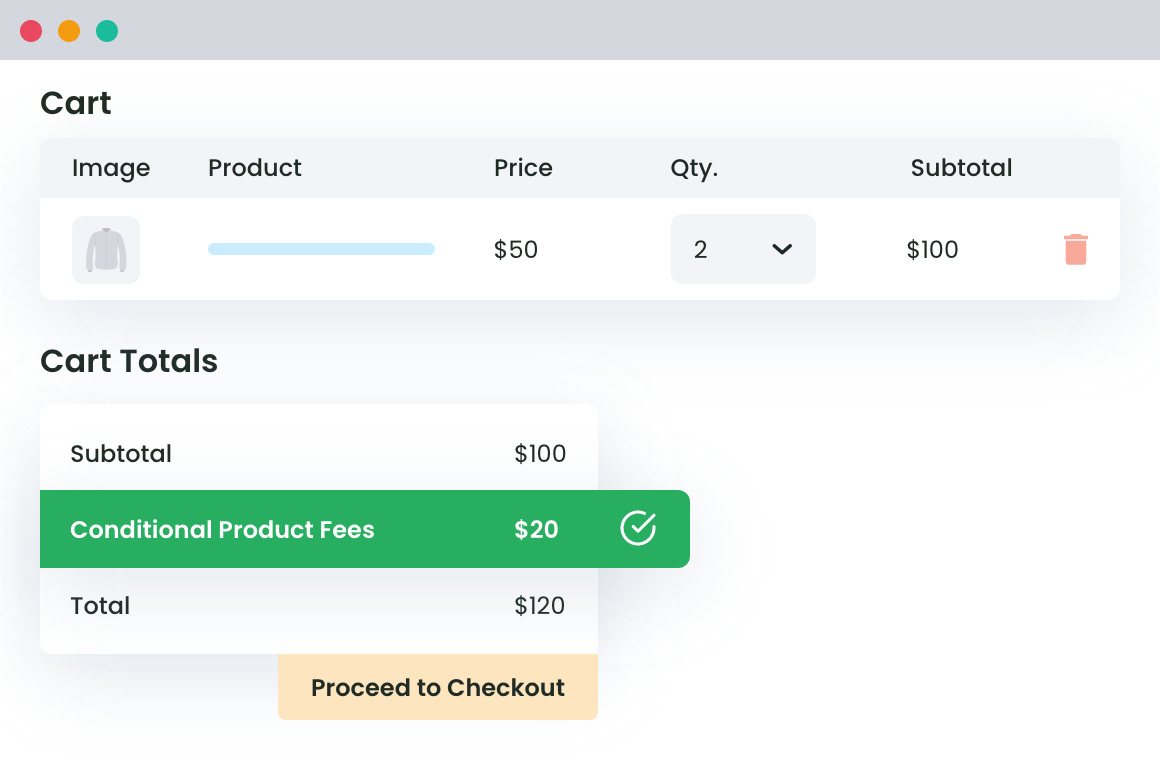

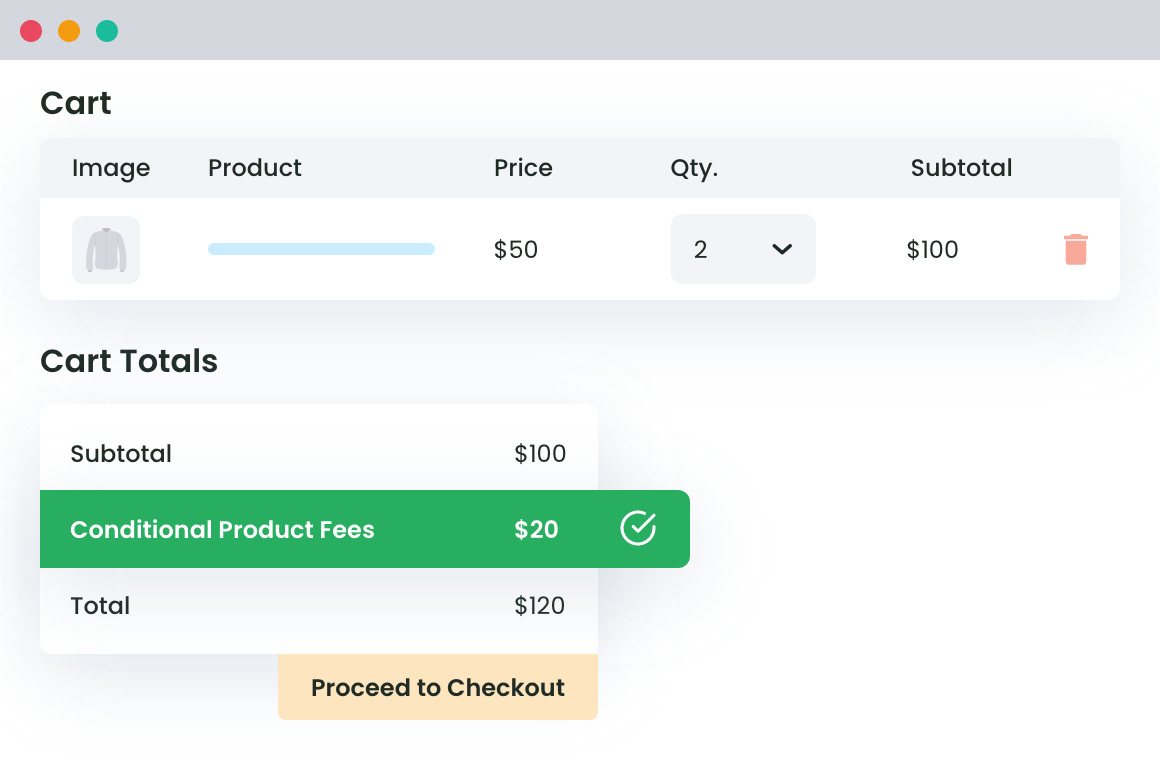

In the cart of your customer, the payment gateway fee (when applicable) will appear in a similar way as shown below:

Looks very clear and detailed without cluttering your checkout page, right? To start using Extra Fees for WooCommerce Plugin, visit this page.

Best Practices for Communicating Payment Gateway Fees

Communicating payment gateway fees to customers is essential to ensure transparency and build trust. Here are some best practices for communicating payment gateway fees:

Clearly disclose all fees: Make sure all fees associated with payment processing are clearly disclosed on the website or checkout page.

Provide a detailed breakdown: Offer a detailed breakdown of the fees charged per transaction so customers know exactly what they are paying for.

Use simple language: Explain the payment processing fees in simple language, avoiding technical jargon that might confuse customers.

Offer alternative payment methods: Provide alternative payment methods that might have lower fees to give customers more options.

Consider discounts or promotions: Offer discounts or promotions to offset the fees and make the overall cost more appealing to customers.

By following these best practices, businesses can ensure that their customers are well-informed and feel confident about the fees they are being charged.

The Importance of Payment Gateway Fee Transparency

Payment gateway fee transparency is crucial for businesses to build trust with their customers and ensure compliance with regulatory requirements. Here are some reasons why payment gateway fee transparency is important:

Builds trust: Transparent payment gateway fees help build trust with customers, who can see exactly what they are being charged.

Ensures compliance: Payment gateway fee transparency ensures compliance with regulatory requirements, such as the Payment Card Industry Data Security Standard (PCI DSS).

Reduces disputes: Transparent payment gateway fees reduce disputes and chargebacks, as customers are aware of the fees associated with payment processing.

Improves customer experience: Payment gateway fee transparency improves the customer experience, as customers can make informed decisions about their payment options.

By being transparent about payment gateway fees, businesses can foster a positive relationship with their customers and avoid potential issues related to hidden or unclear charges.

FAQs about charging payment gateway fees in WooCommerce

Here are answers to some common questions about ways to charge payment gateway fees in WooCommerce.

How to charge payment gateway-based fees in WooCommerce?

The best way to charge payment gateway-based fees in WooCommerce is by using the WooCommerce Extra Fees plugin. Follow these steps:

- Get the WooCommerce Extra Fees plugin.

- Go to Dotstore Plugins → WooCommerce Extra Fees → License, and type in the license key to complete the activation process.

- Next, head to Dotstore Plugins → WooCommerce Extra Fees → Manage rules, and select “Add New”.

- Toggle on the status option and name the specific fee rule.

- Choose the appropriate fee type, either fixed or percentage, and then enter the fee amount.

- Go to the “Conditional Fee Rule” module and select the appropriate payment gateway under “Payment specific”. Then, select “Equal to” and specify the payment gateway for which you wish to charge the fee.

- Scroll to the bottom of the page to save your settings.

How to add a fee to PayPal in WooCommerce?

Follow these steps to add a fee to PayPal in WooCommerce.

- First, Go to Dotstore Plugins → WooCommerce Extra Fees → Manage rules, and select “Add New”.

- Toggle on the status option.

- Name the fee rule. Note that customers will see this on the front end during checkout.

- Choose the appropriate fee type, and then enter the fee amount that you want to charge.

- Go to the “Conditional Fee Rule” module and select the payment gateway condition under “Payment specific”. Then, select “Equal to” and specify the “PayPal” payment gateway.

- Hit “Save changes” to apply the settings.

How to apply a fee for certain payment gateways in WooCommerce?

The WooCommerce Extra Fees plugin makes it super easy to apply a fee for certain payment gateways in WooCommerce. Follow these steps:

- Add the WooCommerce Extra Fees plugin to your site.

- Head to Dotstore Plugins → WooCommerce Extra Fees → License and add the license key to activate the plugin.

- Navigate to Dotstore Plugins → WooCommerce Extra Fees → Manage rules, and click on “Add New”.

- Toggle on the status option and enter a name for the specific fee rule.

- Specify the fee amount that you want to charge.

- Locate the “Conditional Fee Rule” module and choose the Payment Gateway condition from the “Product specific” dropdown. Select “Equal to” from the dropdown next to it. Then specify the payment gatways for which you wish to apply the fees.

- Then, scroll down and save your settings.

How to add a fee for Cash on Delivery in WooCommerce Checkout?

Follow these steps to add a fee for Cash on Delivery to your WooCommerce site using the powerful WooCommerce Extra Fees plugin.

- Navigate to Dotstore Plugins → WooCommerce Extra Fees → Manage rules, and click on “Add New”.

- Toggle on the status option and enter a fee title.

- Enter the fee amount that you want to charge.

- Locate the “Conditional Fee Rule” section and choose the Payment Gateway condition from the “Product specific” dropdown. Select “Equal to” from the dropdown next to it. Then, select “Cash on Delivery” from the dropdown list.

- Scroll down and save the settings.

How to charge payment gateway-based custom fees in WooCommerce?

Setting payment gateway-based custom fees is pretty straightforward. It’s easy to set this up with WooCommerce Extra Fees:

- Get WooCommerce Extra Fees and configure it on your site.

- Go to Dotstore Plugins → WooCommerce Extra Fees → Manage rules.

- Click on “Add New”.

- Enable the “Status” button to make it visible on the front end.

- Update the Fee Title field.

- Enter desired charges in the Fee Amount field.

- Navigate to the “Conditional Fee Rule” tab and select the “Payment Gateway” based condition.

- Choose “Equal to” from the second dropdown menu.

- Then, specify the payment gateways on which you want to charge custom fees.

- Hit “Save changes” to apply the settings.

WooCommerce Extra Fees

Make profits from every confirmed sale through smart, conditional fees.

14-day, no-questions-asked money-back guarantee.