Table of Contents

Goods and Services Tax (GST) is a key part of doing business in countries like India, Australia, New Zealand, and Canada, where it’s applied to most products and services.

For eCommerce stores, charging GST on sales is essential to stay compliant, as these taxes are collected from customers and later paid to the government. However, for WooCommerce users, implementing GST isn’t always straightforward, especially when it comes to managing different tax rates or applying rules based on location.

In this article, we’ll guide you through the essentials of setting up GST rates and tax classes in WooCommerce. We’ll also explore how the WooCommerce Extra Fees plugin can make even complex tax scenarios a straightforward process. By the end, you’ll have everything you need to seamlessly integrate GST in your store, keeping things both compliant and efficient.

WooCommerce and GST: An overview

Thanks to its easy-to-use tax settings, WooCommerce takes the hassle out of managing taxes like Goods and Services Tax (GST) for online stores. You can quickly add GST rates, specify tax zones based on where your customers are located, and decide if taxes apply to product prices, shipping, or both. As a result, you can tailor your tax rules for different regions to suit your business needs.

Setting up GST is a straightforward process; just head to the tax settings and set appropriate tax rates for specific locations. This means you can ensure your customers are charged accurately based on where they are and what they’re buying. Plus, if you want to kick things up a notch, there are plugins available that offer advanced options like conditional logic and location-specific tax rules, making GST management even smoother.

Complying with GST rules is essential for online businesses because it directly impacts:

- Regulations like the Central Goods and Services Tax (CGST) Act require strict compliance, with potential penalties for missing the mark.

- Charging the correct tax amount builds trust, showing customers that your business is transparent and professional.

- Clearly displayed taxes provide customers with upfront information, setting your business apart with a more polished experience.

The Advantages of Proper GST Setup in WooCommerce:

- Better cash flow: With accurate GST calculations, you can manage cash flow smoothly, keeping aside what’s needed for tax payments without disrupting other financial needs.

- Easier reporting and fewer audit risks: A well-organized GST setup simplifies tax reporting, lowering the chance of errors and reducing the risk of costly audits.

- Stronger analytics for tax-related decisions: Tracking GST data effectively provides insights into regional sales trends, helping you make data-driven decisions that fuel growth.

Setting up GST properly isn’t just about staying compliant; it’s about creating a smoother, more efficient operation that benefits your business as well as your customers.

Setting up GST rates and tax classes in WooCommerce

Getting GST set up in WooCommerce is easier than it sounds. Here’s a quick, step-by-step guide to make sure your store’s ready to go:

- First, go to WooCommerce > Settings > Tax and check the box to enable taxes. This opens up all the options you’ll need to handle GST.

- Under Prices entered with tax, choose whether your listed prices should include GST or not. This will keep your pricing consistent across the store.

- WooCommerce offers three options for calculating GST. Pick your tax calculation preferences:

- Billing address: Based on your customer’s billing info.

- Shipping address (default): Based on where items are being shipped.

- Shop base address: Your store’s location.

- Choose the option that best suits your business model and customer base.

- Next, create tax classes like Standard or Reduced Rate for different GST categories. You can set rates and regions for each class.

- Manually add rates for each region, or speed things up by using WooCommerce’s CSV import tool, which can be a real time-saver if you’re covering multiple areas.

- Decide how taxes appear on your product pages, in the cart, and at checkout. This keeps things clear for your customers.

Keeping GST rates up-to-date is key for compliance, so check in on them periodically as regulations change. If you’re looking for extra tips, WooCommerce’s tax documentation has got you covered.

Applying conditional GST with WooCommerce Extra Fees plugin

While WooCommerce covers the basics of GST configuration, such as setting tax rates and display preferences, it may not fully meet the needs of businesses dealing with complex GST scenarios. That’s where an extra fees plugin is needed. The WooCommerce Extra Fees plugin can help you handle advanced GST situations with ease, allowing you to set additional fees and customize GST conditions based on specific requirements.

- Conditional GST application: You can choose to apply GST only when specific conditions are met. For instance, you might want GST to apply based on customer location, product category, order value, or even specific payment methods. This flexibility ensures that GST is accurately charged in diverse situations without requiring

he need for manual adjustments. - Manage multiple product categories: If your store sells a variety of products that require different GST rates, the plugin lets you assign unique rates to each category. This is especially useful if you have items subject to different tax rates, helping you streamline compliance without constant monitoring.

- Add fees based on order conditions: If you want to add extra fees for services like expedited shipping, gift wrapping, or certain payment gateway surcharges, the plugin allows you to automate these fees while ensuring the appropriate GST is added. The result is a seamless experience for both you and your customers.

The WooCommerce Extra Fees plugin gives you the tools to manage GST with flexibility and ease, all while staying compliant and avoiding manual tax headaches. With it, you can build a tax strategy that fits your business perfectly, adding custom tax layers or even excluding certain products from fees when needed.

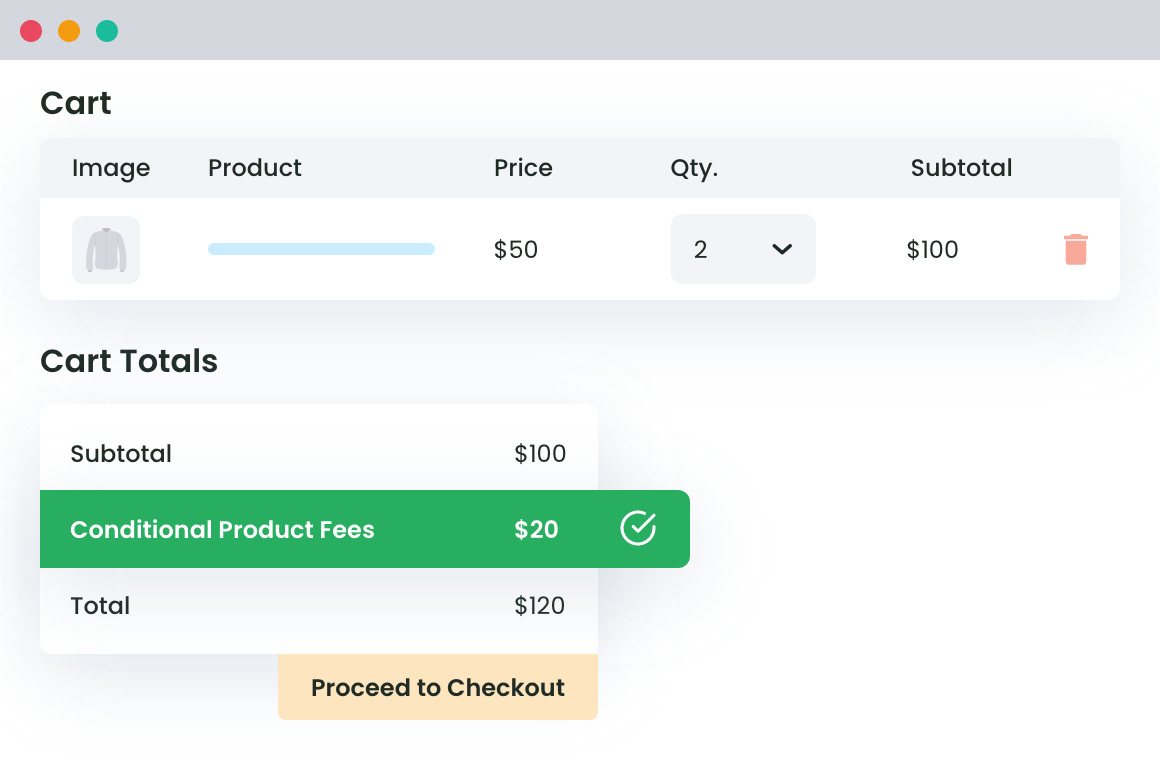

Here’s how it works: The plugin lets you apply specific tax rates to custom fees, keeping GST consistent across both products and additional charges. Just enable the Is Amount Taxable option for any fee you create, select the relevant Tax Class from your WooCommerce settings, and you’re set. WooCommerce then automatically applies the right tax rates, making checkout clearer and smoother for everyone.

Once configured, the plugin ensures that each custom fee shows the correct tax rate directly in the cart, creating an accurate breakdown of costs. Whether it’s an added fee for expedited shipping or a payment gateway charge, customers will see a straightforward tax calculation that makes sense.

With the WooCommerce Extra Fees plugin, GST setup becomes part of a smooth, automated process tailored to how you run your store.

- Applies GST across products and any added fees, ensuring straightforward and reliable tax info for you and your customers.

- Customize tax rules to fit your specific needs, whether it’s based on product category, customer location, or order type.

- Taxes are calculated automatically according to your settings so you can focus on growing your business.

Note: While this plugin takes the stress out of GST management, it’s smart to double-check calculations and consult a tax expert to ensure you’re fully compliant.

How to create GST rules for various scenarios

Creating customized GST rules in WooCommerce allows businesses to stay compliant while adapting tax rates to various conditions. With the right approach and the plugin’s conditional logic features, you can easily manage various GST scenarios tailored to your business needs.

1. Configure product categories

Start by categorizing your products. In countries like India, different products fall under specific GST slabs, such as 5%, 12%, 18%, or 28%.

How to set up: Navigate to the WooCommerce settings and define product categories. Assign the appropriate GST rate for each category based on local regulations. For example, essentials might fall under a lower slab, while luxury items could attract a higher rate.

2. Set location-based adjustments

GST rates can vary significantly by location, especially in large countries with multiple states.

How to set up: Use the conditional logic feature to create rules based on the shipping address. For instance, configure your store to apply IGST for inter-state sales and CGST/SGST for intra-state transactions. This ensures your customers are charged accurately based on their shipping location.

3. Tailor fees based on user roles

If your business caters to both retail and wholesale customers, user roles are crucial for applying distinct tax obligations.

How to set up: Create user roles in WooCommerce and set specific GST rules for each role. For example, wholesale buyers might benefit from reduced GST rates or exemptions, reflecting their unique purchasing power.

4. Payment gateways

Different payment methods can also impact how GST is calculated.

How to set up: Establish rules where specific fees are applied based on the selected payment method. For instance, you might want to add a small fee for credit card payments due to transaction costs, which could also affect the total GST charged.

5. Adjust based on order value

In some regions, bulk orders may qualify for GST exemptions or reduced rates, promoting larger transactions.

Example: In India, the Composition Scheme allows small businesses with an annual turnover below ₹1.5 crore to pay a lower fixed GST rate. Set rules to automatically apply for these benefits during the checkout process for eligible orders.

Combining multiple conditions: To address complex GST implementations, you can combine various conditions within the plugin. For example, a product might have different rates based on its category, the customer’s location, and its user role. This multi-layered approach ensures compliance while maximizing efficiency.

One of the plugin’s standout features is the ability to display fees directly on the product page. This transparency lets customers see applicable fees based on their cart and user conditions before checkout, significantly improving their shopping experience. For instance, if a customer adds a high-value item that triggers a different GST rate, they’ll see the adjusted fee instantly.

Consider utilizing the merge all fees feature to combine multiple charges under a single label, such as “tax” or “handling fees.” Custom tooltips can enhance clarity, making it easier for customers to understand their charges during checkout.

Regularly test your GST rules to ensure they work as intended. Simulate various scenarios – such as different user roles and product categories – to verify that the correct fees are applied.

Finally, remember that GST regulations may change over time. It’s essential to stay informed about any updates to tax laws and adjust your GST rules accordingly to maintain compliance and avoid potential penalties.

Streamlining GST reporting in WooCommerce

GST reporting is a crucial aspect of tax compliance for eCommerce businesses. Fortunately, WooCommerce offers several features that significantly simplify this process:

- Sales reports: WooCommerce provides detailed sales reports that break down your revenue, including the GST collected. These reports can be filtered by date range, making it easier to compile data for monthly, quarterly, or annual GST returns.

- Tax reports: The platform offers specific tax reports that show the total tax collected, categorized by tax rate. This feature is particularly useful for businesses dealing with multiple GST rates.

- Export functionality: WooCommerce allows you to export your sales and tax data in CSV format, which can be easily imported into accounting software or spreadsheets for further analysis or reporting.

- Integration with accounting software: Many accounting plugins are available that can integrate WooCommerce with popular accounting software such as Tally, QuickBooks, or Xero, automating the transfer of sales and tax data.

- Order details: Each order in WooCommerce includes a breakdown of the taxes applied, providing a clear audit trail for tax authorities if needed.

Utilizing these features allows businesses to save time, minimize errors in GST reporting, and stay well-prepared for tax filing deadlines and potential audits.

Optimize your WooCommerce GST management today

Setting up GST correctly on your WooCommerce site is crucial for complying with regulations and avoiding potential financial losses. Keep in mind that GST rates and rules can vary significantly between countries. The specific examples mentioned, such as India’s GST structure, are not universally applicable. Also, note that it is essential to consult a tax professional about your unique situation, as tax laws can change over time.

If you’re using WooCommerce for your eCommerce site, implementing GST can be straightforward.

But optimizing your GST processes is an ongoing effort, so regularly refining your approach will help ensure compliance and efficiency. The WooCommerce Extra Fees plugin is a valuable tool that enhances GST management by allowing you to apply both simple and conditional extra fees effortlessly. This flexibility enables you to customize your fee structures to meet your specific needs.

We encourage you to review your current GST setup and consider implementing the optimization strategies discussed here. Don’t wait; explore the WooCommerce Extra Fees plugin for advanced fee management.

WooCommerce Extra Fees

Make profits from every confirmed sale through smart, conditional fees.

14-day, no-questions-asked money-back guarantee.